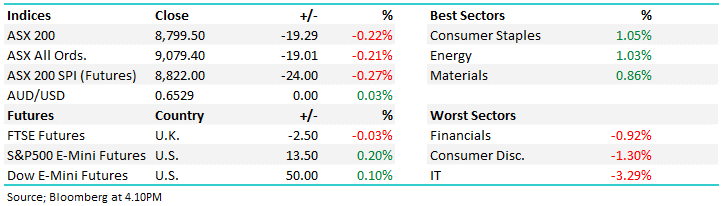

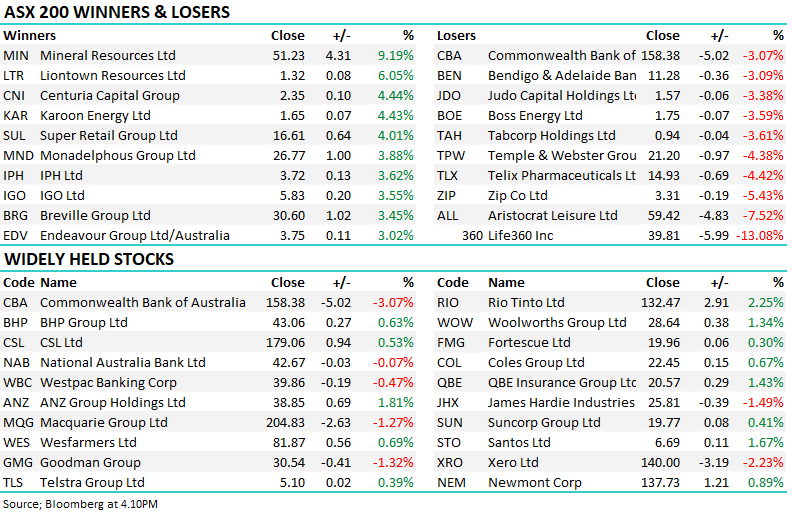

The local market fought valiantly on Wednesday to recover from a very shaky start finally closing down exactly -0.5%, although only 31% of the market closed up on the day a strong session across the influential Banking Sector was enough to offset the broad based losses across the tech and resources stocks. The sentiment towards the banks appears to have lifted following yesterday’s RBA comments which strongly implied they would start hiking interest rates sooner rather than later, historically banks improve their margins in a higher rate environment, assuming bad debts remain stable. Our view towards the sector hasn’t changed for months and if MM is correct things should start to get interesting:

- MM has been bullish the Banking Sector post COVID but we believe the bullish advance is maturing fast.

- Even after paying a healthy $1.75 fully franked dividend in February CBA is only 4.2% below its all-time high.

- We are not pressing any sell / reduce buttons just yet but for the first time in 2-years the risk / reward isn’t appealing.

We read Jamie Dimon’s annual letter to shareholders with interest this week as it focused on the Feds 180 degree transition from Quantitative Easing (QE) to Quantitative Tightening (QT) – a new acronym for 2022/23:

- He believes the Fed’s very necessary tightening cycle is likely to go higher than most economists are forecasting.

- US 10-year yields have already surged from under 1.5% at the start of the year to over 2.5% as I type, a huge move but he feels there is plenty more to come – not good news for mortgage holders.

- Overall MM believes he’s correct but it wont be one-way traffic and by definition this huge change in stance from central banks is going to increase volatility and offer opportunity for the prepared.

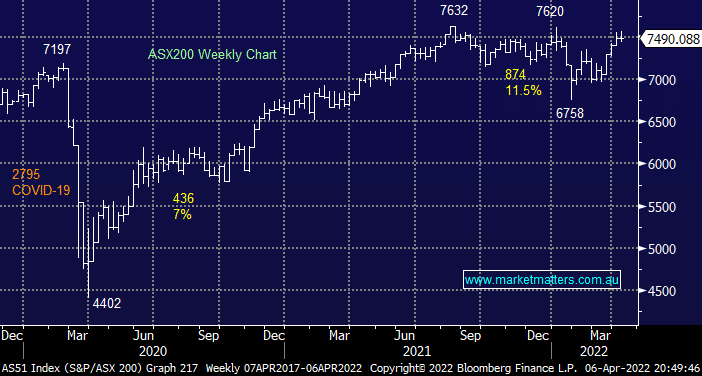

We feel the local markets simply taking a well-deserved breather around the 7500 area after rallying strongly through March but the index still feels resilient into weakness as we saw yesterday with the Australian market managing to largely ignore sharp drops across Asia and the US – so far the Feds hawkish rhetoric has had a more significant impact on stocks than our own RBA.

Overnight we saw US stocks drift lower with the S&P500 closing down 1% while the hawkish Fed sent the tech stocks down -2.2% i.e. 0.5% hikes now look very probable through 2022. Under the hood it was a classic “risk off” session which saw 5 of the 11 S&P sectors still close up on the day:

- Consumer Staples +1.4%, Energy +0.5%, Healthcare +1.6%, Real; Estate +1.6% and Utilities +2% – we believe these will make up the core of the best performing sectors through 2022/23.

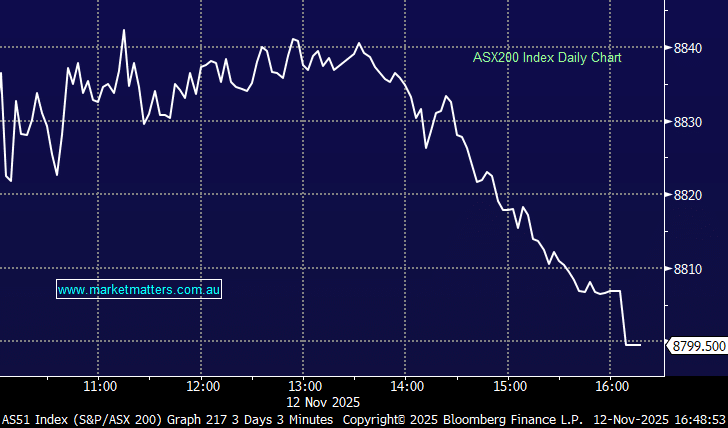

The SPI Futures are calling the ASX200 down around -0.2% this morning which feels like another solid start to a day considering overseas moves.