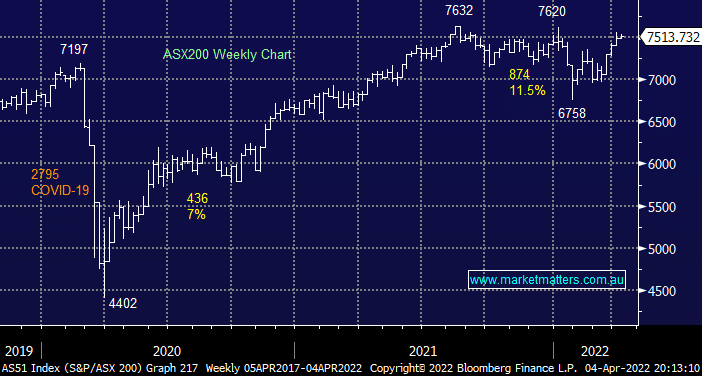

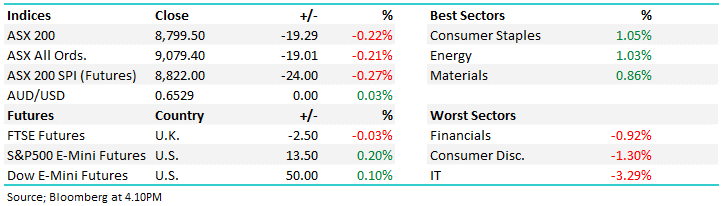

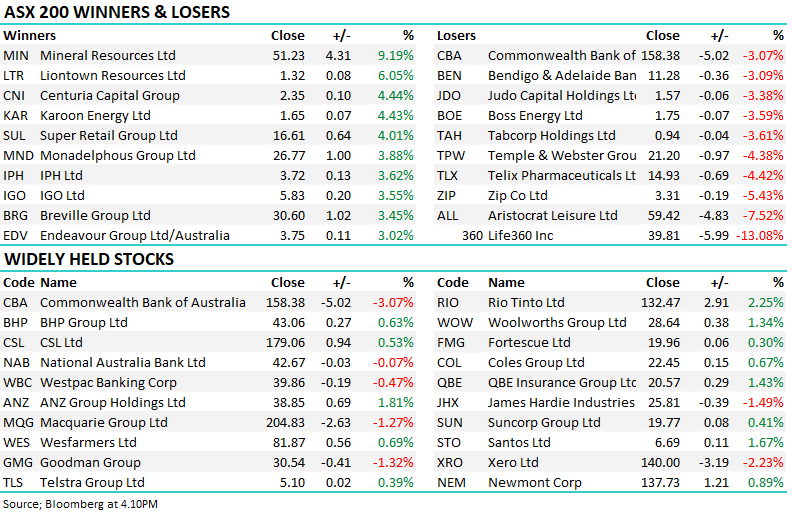

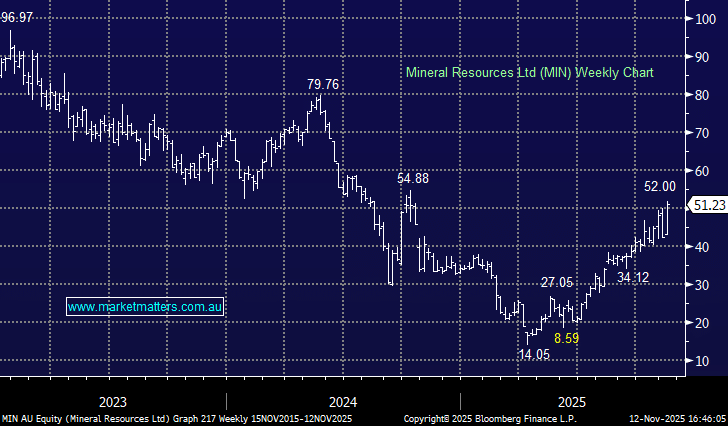

We’ve started off the first full week of April with a small +0.3% advance courtesy of broad-based gains offsetting a tired looking Banking Sector although the miners and utilities stocks continued to shine as they have through most of 2022 – if the market remains in sync with our roadmap for the year we see no reason to anticipate a significant change in relative sector performance until we do find an inflection point. This ties in with our recent stance towards the local miners:

- At this stage of the cycle we believe it’s way too late to be buying resource stocks but while we believe the sectors 2-year advance is maturing fast their upside momentum remains strong – see 3 examples later in today’s report.

Since the start of the millennium the first 8 trading days of April have delivered an average gain of +1.6% which would take the market back to its all-time high hence we believe patience is still required with regard to any general selling – incredibly the banks / resources have rallied over 90% of the time over this period suggesting the market won’t change its tune for at least a week, or two. Please excuse the large dose of statistics but when over 65% of the index is set for a strong few weeks its likely to have a meaningful impact on the indexes likely direction and overall market sentiment.

The markets set for some good old fashioned economic fundamentals this week after basically ignoring US employment data on Friday that was slightly better than expected – US bond markets are already pricing in over 2% worth of rate hikes by Christmas taking interest rates back to 2.5%, that’s aggressive stuff which so far the market has absorbed reasonably well.

- At 2.30pm this afternoon we will see the latest decision on interest rates from the RBA – the markets looking for no increase to the current 0.1% official rate.

- At 4am on Wednesday we see the latest US FOMC minutes which should tell us if the markets are picking the correct path for Fed rate hikes into Christmas.

Overnight we saw US stocks rally with the tech names and especially Twitters surge after Elon Musk took a 9.2% stake in the company – at one stage the Twitter Inc was up over 30% before closing up an impressive 27%, I wish stocks would pop so significantly after MM appeared on their register! Also Chinese listed tech names like Tencent and Baidu rallied after China removed a problem hurdle by allowing the US full access to audits.

The SPI Futures are calling the ASX200 to rally 50-points this morning back above 7550 even as BHP Group (BHP) and iron ore slipped slightly lower.