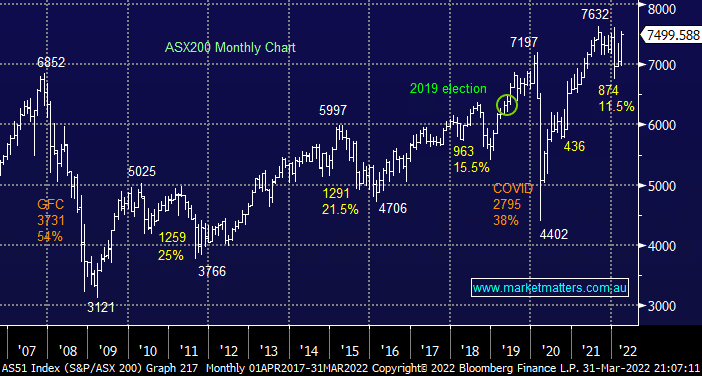

Yesterday we waved goodbye to a volatile Q1 which saw the ASX200 initially drop -9.2% in January before slowly but surely recovering all of the losses before managing to end the quarter slightly higher. The highlight of the last 3-months would probably go to the explosive rise in bond yields but there were a few rivals for the mantle including surging commodity prices courtesy of Russia’s invasion of Ukraine and supply chain issues which stubbornly aren’t going away, the net result was a market of 2 halves, excuse the cliché, with value stocks like banks and resources rallying at the expense of growth names such as tech and healthcare.

It’s time to look forward to Q2 which we believe is likely to deliver further volatility both above and below the hood but with some definite differences from the previous quarter:

- MM’s preferred scenario is the ASX will rally through April before struggling in the traditionally weak May & June i.e. back to front compared to Q1 and in line with our “sell the pop” mantra for 2022.

- After anticipating strong outperformance from the banks & resources in early 2022 we think it could be a very different tale in Q2 with the “easy money” this year for the value Sector behind us.

Over the last 2-weeks we’ve made a few comments along the lines of “we believe it’s too early to sell the banks but it remains likely to be our next portfolio tweak”, this view remains in play and if we are correct and the ASX200 breaks to fresh highs next month subscribers should expect to see us migrate clearly down the risk curve with some of our best performing positions likely to be cashed in – it won’t be long until the market reveals all but at this stage if we replicate Aprils performance of the last 2-years 7800 is easily achievable.

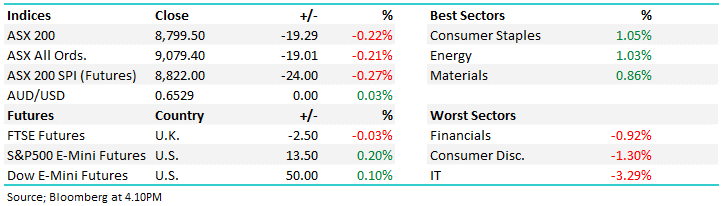

Overnight we saw US stocks fall aggressively into the close with the S&P500 posting its 1st negative quarter since the pandemic bear market 2-years ago, the session saw bond yields pare some of their largest gains in 5 decades and oil tumble well over 6% after Joe Biden urged the release of huge oil reserves. The SPI Futures are pointing to a -0.6% dip early on today which feels about right with BHP Group (BHP) basically unchanged in the US.