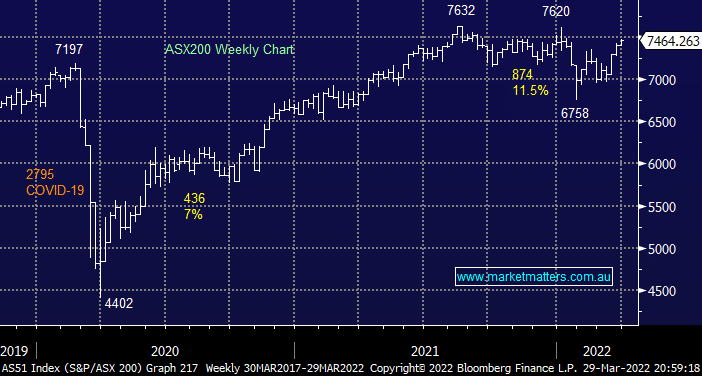

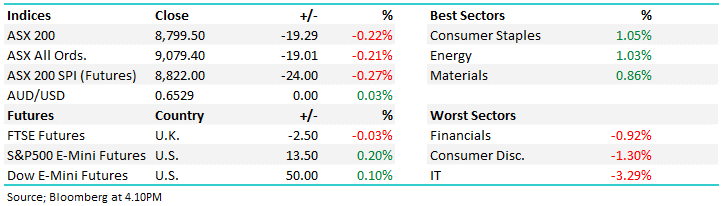

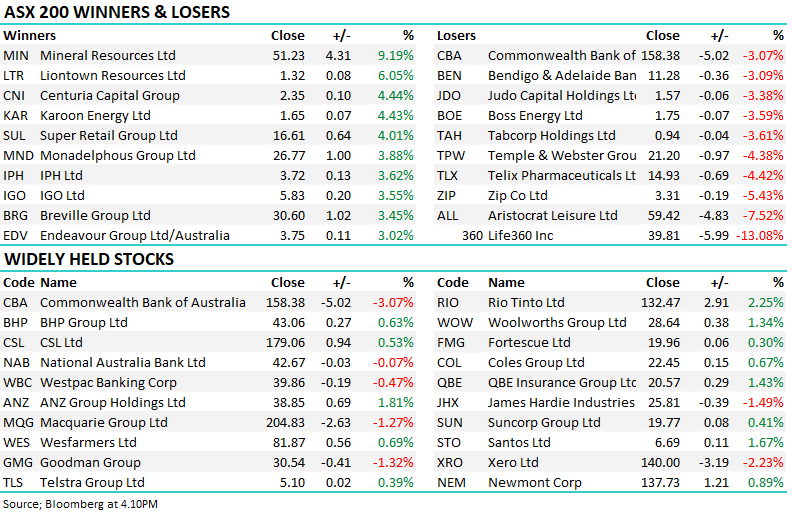

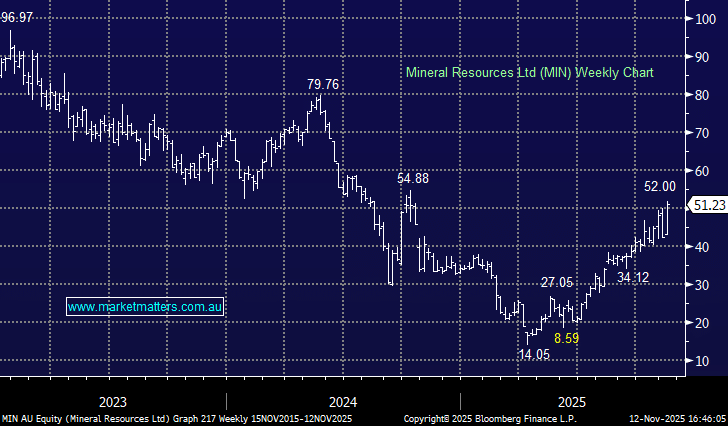

The ASX200 rallied another +0.7% on Tuesday taking the local index to within 2.3% of its 2021 all-time high – our call for a test of 7700-7800 through March & April is starting to feel almost conservative. Gains were broad-based yesterday with over 75% of stocks rallying, only the previously “hot” energy and resources stocks slipped lower while growth stocks regained their mojo with a small degree of gusto as bond yields took a rest, although there was no signs of them falling.

- Australian 3-year bond yields have already surged from under 1% to challenge 2.5% over the first 3-months of 2022.

- During the same period we’ve seen the banks rally and resources surge while healthcare / IT stocks have been slammed.

NB banks / resources are referred to as value stocks and healthcare / IT as growth with the later generally adversely influenced by rising bond yields.

The value versus growth relative performance elastic band has continued to stretch as inflation & bond yields have soared ever higher but perhaps we are starting see glimmers that some sector reversion can unfold if yields simply take a rest. History tells us that underperformers often play some catch up at the mature end of a bull cycle, this scenario would dovetail nicely with our “sell the pop” view towards a rally above 7650. A quick reminder for the mathematicians out there as to what usually comes next as we kick off April on Friday:

- April is historically the ASX200’s 2nd strongest month of the year as investors receive huge dividends which are often invested straight back into the market especially as 3 of the “Big 4” banks trade ex-dividend just a few weeks later, in May.

Inflation /yields are undoubtedly the major factor driving stocks, sector and equity indices hence today we’ve taken a look at few different examples of bond performance and their important correlation to major market sectors – there are some extreme moves out there!

Overnight US stocks continued to regain some of their 2022 losses with the Dow gaining over 300-points and the tech sector performing even better rallying +1.7%. The SPI futures are pointing to another 0.7% gain early by the ASX200, taking the index above 7500 even with the miners looking likely to be a drag on the index with BHP Group (BHP) down 35c in the US.