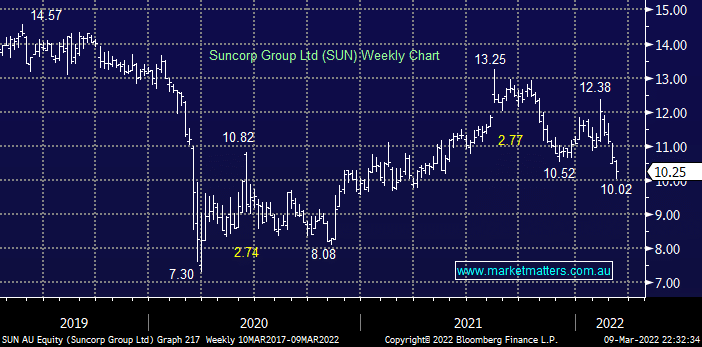

Queensland based SUN has forecast its maximum retained cost from the floods will be about $75mn but although the stock delivered a solid result last month sentiment is clearly against the sector due to the combination of a nervous stock market, bond yields upside momentum waning on economic concerns around Ukraine and now the floods. The stocks strong yield and recent 24% pullback leaves us neutral to slightly bullish SUN.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral to positive SUN around $10

Add To Hit List

Related Q&A

Emeco (EHL) and Suncorp (SUN)

Suncorp (SUN)

The Performance of Suncorp (SUN)

ANZ purchase of Suncorp

Thoughts on SUN

Q&A -weekend report – SUN

Q&A -weekend report – DRO & SUN

Thoughts on Suncorp (SUN) please

ANZ’s Suncorp Take Over

Thoughts on the ANZ / SUN potential sale

Dates on Suncorp divestment to ANZ please

What is MM’s current view on Suncorp (SUN)?

Does MM like SUN after its strong rally?

What are MM’s thoughts on the ANZ – SUN tie up?

Banks & / or insurers as rates rise?

Semi Conductors

How do you get the yield on the SUNPI?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.