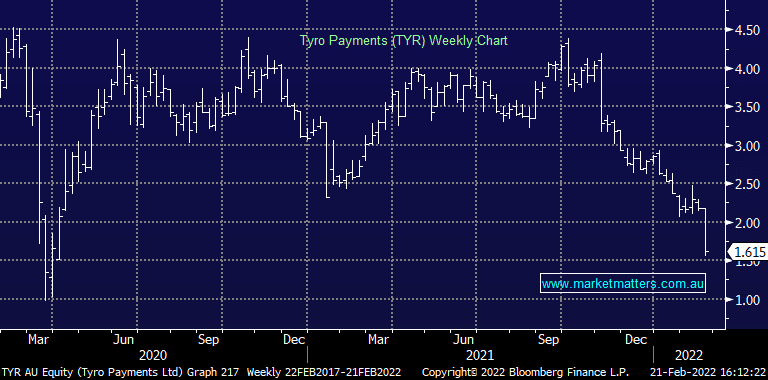

TYR -25.92%: a very weak first half result today saw significant pressure put on shares in the payments solutions business today. Tyro saw transaction volume and revenue jump around 30% each, but EBITDA fell 67% to $2.8m on higher costs. There was a significant jump in merchant numbers but transactions were weighed on by extended lockdowns in NSW and Victoria. Costs were also up, the company noting wage inflation, higher investment costs associated with their Telstra partnership and recent Medipass acquisition and extending assistance to merchants including deferring fee increases. The result was a decent miss to expectations and they are now well behind the 8-ball in terms of meeting full year expectations. There was an obvious (large) seller of the stock in the market today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is reviewing its position in TYR

Add To Hit List

Related Q&A

Buy/Hold/Sell

Thoughts on IEL, LOV, FDV and TYR please

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

What are your thoughts towards the TYR situation?

Is TYR being regarded as BNPL stock?

Thoughts on TYRO (TYR) Payments?

Emerging Companies TYR and ZIP a hold or sell?

Does MM see trading Opportunities in ELO, EML or TYR?

Is it time to take tweak some positions?

Questions on Tyro Payments (TYR), Northern Star (NST) & Neometals (NMT)

TYR & LVMH question

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.