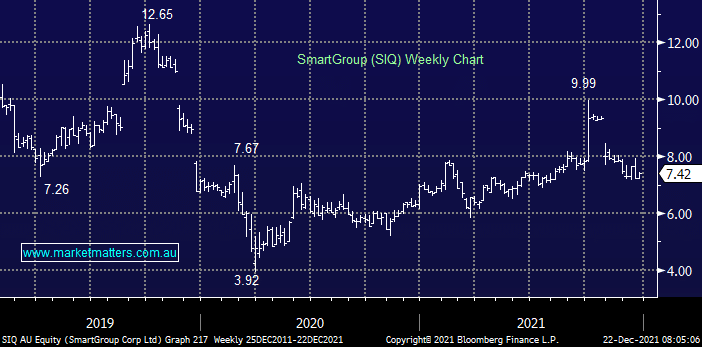

I have this salary packaging business in my grandmas portfolio and we’d be happy buyers today. While it’s not exciting, there are 3 key aspects we like:

- Technology can drive scale in this business which is what we believe underpinned the recent (but failed) bid from private equity at $10.35

- We expect SIQ to have net cash on their balance sheet and be in a position soon to initiate capital returns via a special dividend

- The stock is solid value trading on a forward P/E of 14x and offering a projected fully franked yield of 6.27%