Hi Craig,

VUL is another clean energy company already valued at $1.5bn – the business is aiming to produce battery quality lithium hydroxide with a net zero carbon footprint from its resource in Germany. This sort of development is becoming very popular in many commodities driven by customers like Tesla. We hosted a senior exec from Tesla a few weeks ago at a battery metals day and one key aspect that was abundantly clear is that they care deeply about how the raw materials they are using are produced from both an environmental perspective, but also in terms of the social and governance aspects like worker pay, human rights and the list goes on. Gina’s involvement in VUL gives the whole business credibility, she’s an impressive businesswoman who doesn’t back losers too often.

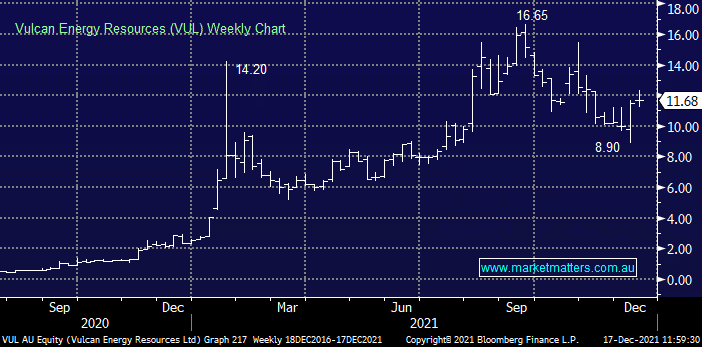

Interestingly, VUL rallied strongly recently after short seller J Capital was forced to apologise after a scathing bearish note on the business and its goal of a zero carbon footprint. From a prince perspective, considering where the stock was 12-months ago we cannot get too excited from a risk / reward perspective leaving us neutral the stock in the $11.5-$12 region.