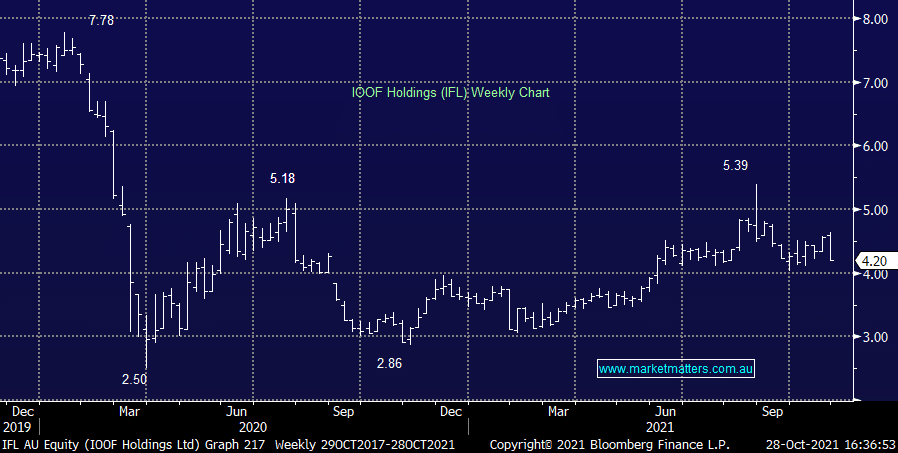

IFL -8.5%: The weath manager provided a trading update today and while they sighted growth in funds it was market gains (+$5bn) that did the heavy lifting, overcoming around $2.3bn in outflows for the 3 months to September 30. They also changed some methodology around how they report funds under advice as they continue to harmonise the significantly expanded business. This is all still a work in progress with a lot more to do and it’s easy to see why the market has sold them off ~8% today given the outflows mentioned above, particiuarly when we put the IFL experience up against the independent platforms like HUB and Praemium. Having said that, we own IFL in the MM Income Portfolio from ~$3.60, we are backing the turn around that’s underway however we need to remain realistic on the task at hand. It’s complciated, is not a quarterly proposition however the stocks is priced accordingly.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains a holder of IFL in the Income Portfolio

Add To Hit List

Related Q&A

IFL – Buy, Hold or Sell

Fund Managers

Updated view on few battered up stocks?

Where’s IFL going?

Am I missing something on IOOF Holdings (IFL)?

MM thoughts on IFL & AMP

Why do you hold IOOF Holdings (IFL)?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.