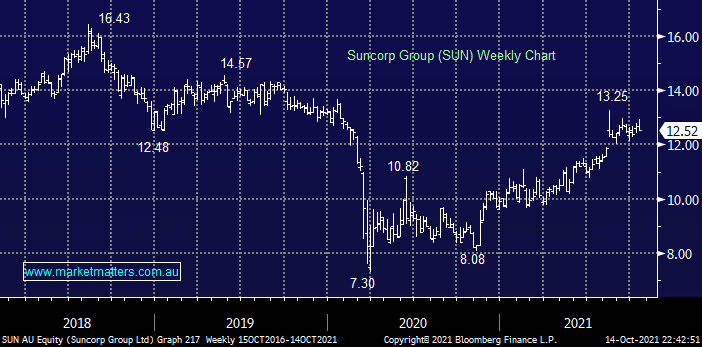

Bank / insurer SUN was one of the markets worst performing stocks yesterday although it fell less than 2%. If the company experiences a tough few weeks MM will definitely have the stock on the radar, especially with its attractive forecasted 6.55% yield over the next 12-months making it a candidate for both of our Flagship Growth and Active Income Portfolios.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is keen on SUN under $12, or 5% lower

Add To Hit List

Related Q&A

The Performance of Suncorp (SUN)

ANZ purchase of Suncorp

Thoughts on SUN

Q&A -weekend report – SUN

Q&A -weekend report – DRO & SUN

Thoughts on Suncorp (SUN) please

ANZ’s Suncorp Take Over

Thoughts on the ANZ / SUN potential sale

Dates on Suncorp divestment to ANZ please

What is MM’s current view on Suncorp (SUN)?

Does MM like SUN after its strong rally?

What are MM’s thoughts on the ANZ – SUN tie up?

Banks & / or insurers as rates rise?

Semi Conductors

How do you get the yield on the SUNPI?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.