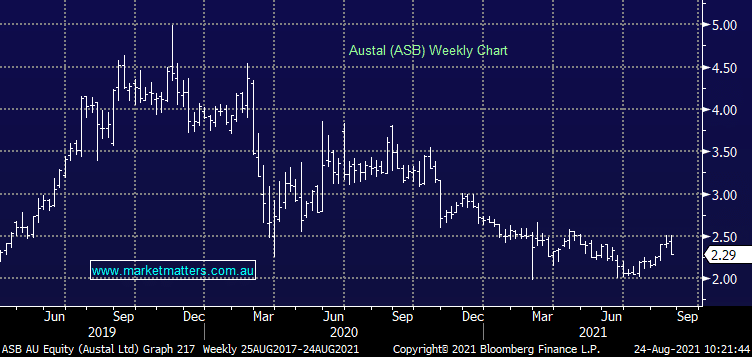

FY21 Result: the full year results looks to have come in above expectations for the shipbuilder Austal. Revenue was in line at $1.57b, while NPAT fell to $81.1m during the year, it was ~5% above expectations. Recent news flow has been positive for Austal, winning a number of contracts and slowly working through historical issues with the US Navy. Guidance implies flat revenue in FY22, though this number has been propped up by using AUDUSD price of 75c, ~4% above where the currency currently trades. ASB was trading down 8.37% at the time of writing

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains long and bullish ASB

Add To Hit List

Related Q&A

Q&A for Sat Weekend report – ASB & XRO

Thoughts towards Austal (ASB)

Thoughts on ASB after its downgrade?

Thoughts on Capitol Health, Austal and Standline Resources?

Austal (ASB) – is it a buy?

Is Austal a takeover target?

Austal (ASB) share price decline

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.