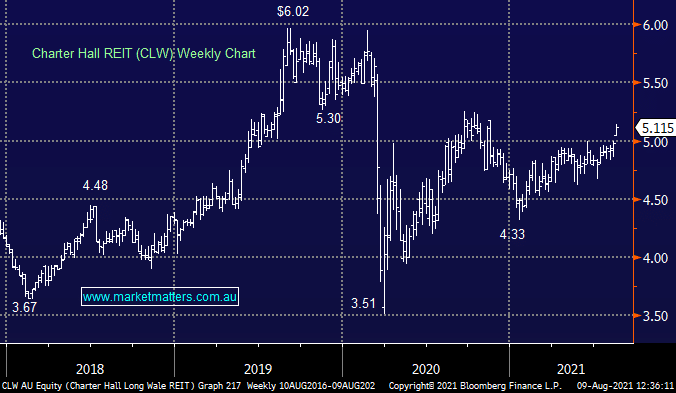

CLW +2.5%: A solid result today from a very solid real-estate investment trust. Operating earnings of $159m were inline with expectations as was the distribution of 29.2c. Interestingly, their Net tangible assets (NTA) increased 16.8% showing good gains from their property portfolio which now sits at $5.6b having raised additional equity through the period. Gearing sits at 31.4% which is in the middle of their targeted range while their weighted average lease expiry (WALE) is now 13.2 years. This is a very solid REIT expected to yield 5.7% over the next 12 months (unfranked). We did hold this previously in the Income Portfolio and made a mistake selling it due to our concern around rising bond yields.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is now neutral/bullish CLW around $5.10

Add To Hit List

Related Q&A

Which REITS have the most capital upside?

Thoughts on Charter Hall REIT (CLW) after its result?

Does MM like REITS CLW & CHC?

What does MM think of CNI, CLW & LLC into current weakness?

MM’s Thoughts on CLW?

MM thoughts on CLW

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.