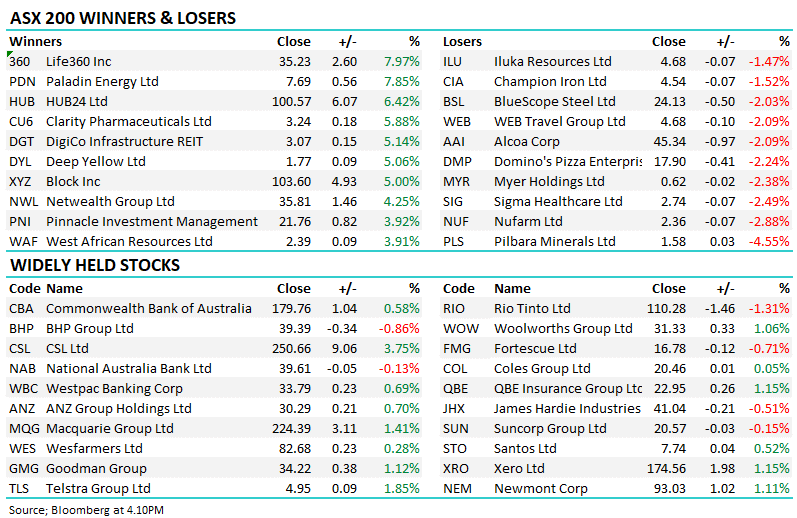

Xero (XRO) full year result continues positive trends

Xero (XRO) -4.77%: Full year results for the accounting software provider and the stock dropped on the back of it. The short-term numbers were a tad below market expectations which accounts for the weakness, revenue $718m v $730m exp, EBITDA $137.7m v $150m expected while they booked a small net profit for the year.

This business is all about growth and to that end they added 467k subscribers for the year taking total subscribers to 2.285m. As a subscription business (similar to MM on a bigger scale), two things are really important – I look at these closely for MM and their important for Xero. Churn rates which mean the amount of subs that sign up then leave remains low (1.13%) and falling, although there was an uptick in the UK which shows a degree of linkage between churn and the economic situation - higher business failures not a good thing. In any case, customer churn of 1.13% is low and implies customers love the product – I certainly do as does my accountant.

The other one is total lifetime value. A subscriber is worth $2,422 to Xero over their lifetime multiplied by the number of subscribers. In Xero’s case, its $5.5b up $1.2bn on the year or 27%. Interestingly, the SP is up about 30% over the past 12 months.

Source: Xero

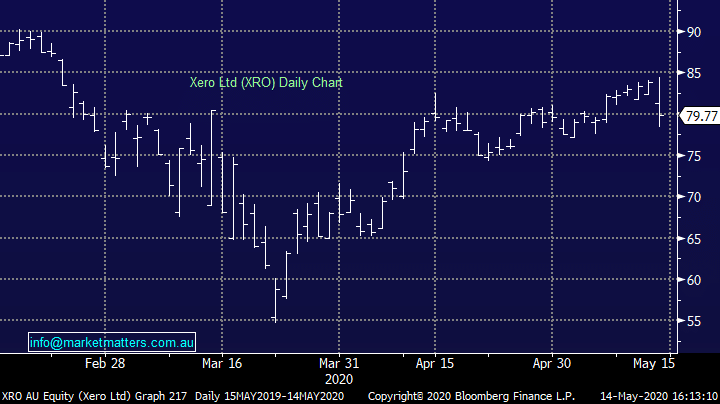

Xero (XRO) Chart

Source: Xero

Xero (XRO) Chart