Graincorp (GNC) first half shows positives in simplified business

Graincorp (GNC) +11.55%: shot higher, reversing a soft start to the week with the market concerned with China’s keenness to tariff Australian exports. Today though the focus was turned back on to the businesses strong first half trade which saw earnings swing back into a profit. The 1st half EBITDA figure of $183m was a beat on consensus – though the consensus did house a wide range of views from $40m to $255m.

It was a busy first half for the company which saw the sale of the Bulk Liquid Terminals segment as well as the demerger of United Malt (UMG) back in March. The successful completion of both deals means GNC has no debt on balance sheet. They talked to positive signs ahead of the FY21 harvest with recent rainfalls meaning soil moisture levels are favourable as well as talking up exports into the second half. A fight with China would hit GNC, but we see this as an unlikely path, and now with a bit more direction, Graincorp looks reasonable.

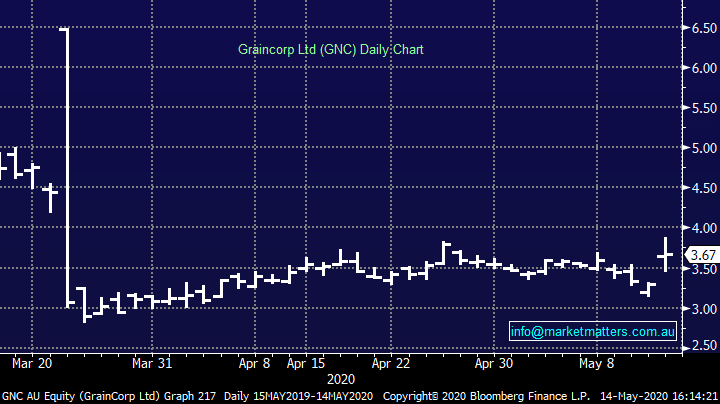

Graincorp (GNC) Chart