Will the dream run for Aussie tech names continue?

The bulk of the stocks outlined below have enjoyed an exceptional run in the last 12 months – a combination of good growth, good stories and a market that is happy to pay up for both.

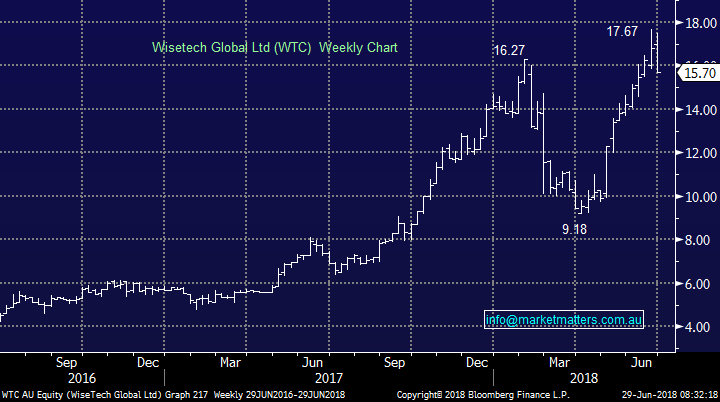

1 WiseTech Global (WTC) $15.70

An exceptional performer in FY18 adding ~121%, with the logistics software company growing organically but also through a string of acquisitions. They now trade on a huge 108x forward earnings however their growth rates are big. One measure we often use is price to growth which divides price to earnings by the earnings growth rate (PEG). In terms of WTC, this is on a PEG of 4.04 Technically, a pullback towards $10 would not surprise, especially with the NASDAQ association but we have no clear signals as yet. WiseTech Global (WTC) Chart

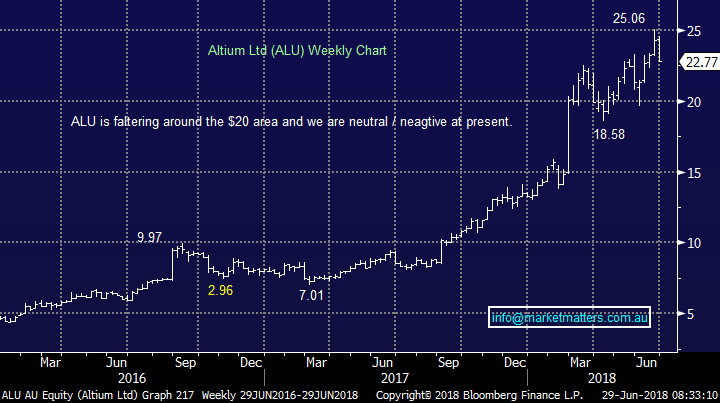

2 Altium (ALU) $22.77

Altium is a printed circuit board design software provider that has also enjoyed an exceptional run in FY18 adding 154%. Printed Circuit Boards (PCB’s) are found in pretty much every electrical device and a simple scope around the house shows that we have more electrical devices now than ever before – and the trend is only going one way! Technically, ALU looks very vulnerable to test back below $20. Altium (ALU) Chart

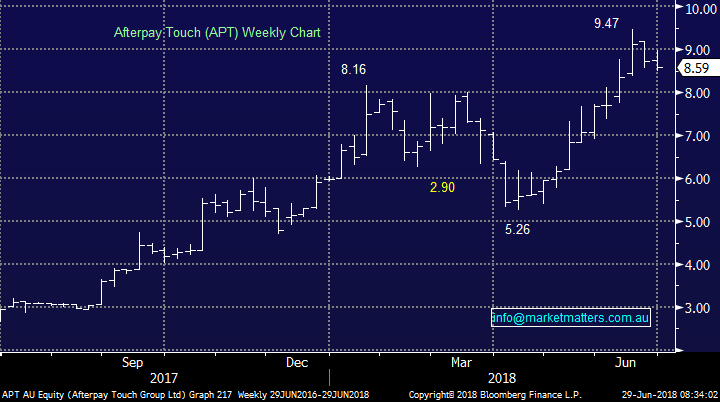

3 Afterpay Touch (APT) $8.59

Just as the name suggests, this is an online payment system used by a huge number of users around the country (and now in the U.S) to buy things, and pay for them later – a new age version of the lay-by system. Again, a company that has run hard this year but the obvious question now is will it continue to run in FY19? It trades on a massive P/E of 150x however it’s all about growth, a lot of which seems to be built into the price. Technically, APT remains bullish but we would not be long if it cannot hold $8 and it would technically then test $5 fairly quickly – a scary thought for holders. Afterpay Touch (APT) Chart

4 Zip Co (Z1P) 0.865c

A company with some similarities to AfterPay however they provide finance for larger purchases at the point-of-sale mainly in travel, retail, health and even education. We’ve covered Z1P earlier in the year as a BUY however we did not pull the trigger. The concern for Z1P (and APT) is around the prospect for regulation which would hurt the sector in the short term (but would ultimately create higher barriers to entry for potential new entrants). Technically, Z1P is in the too hard basket but a break back under 78.5c looks likely to us Zip Co (Z1P) Chart

5 Appen (APX) $13.17

Appen is involved in the growing area of AI (artificial intelligence) providing high quality data to a large cross section of corporates. This is clearly a growing area and Appen is well placed to take advantage of it. A 238% gain this year in its share price is impressive however APX trades on 40x next year’s projected earnings – a less scary proposition than some others. APX looks neutral just here but technically we would be a seller of fresh highs. Appen (APX) Chart

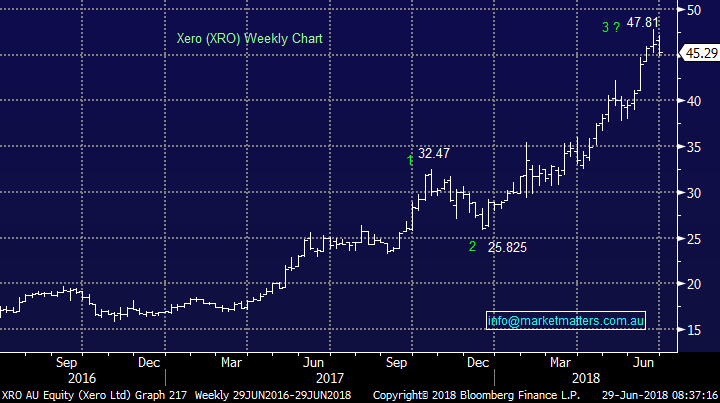

6 Xero (XRO) $45.29

Online cloud based accountancy software that is loved by many accountants including my own. XRO is clearly in the popular space at present but as such, it’s not cheap but nor should it be! Like much of the tech space, it's volatile and chasing strength as opposed to buy one of the regular pullbacks. These pullbacks tend to put pressure on investors’ minds. Technically we are neutral here but interested into a pullback below $40 Xero Ltd (XRO) Chart