The Aussie market finishes the financial year softer

WHAT MATTERED TODAY

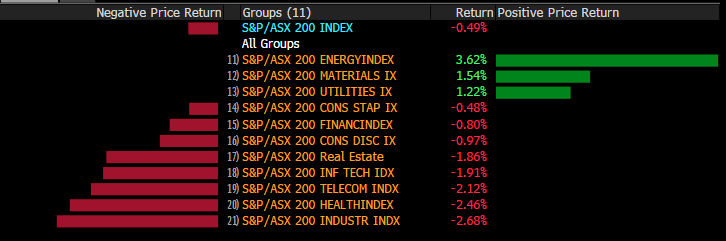

As the financial year comes to a close, the market didn’t quite know what to think today and fluctuated around yesterday’s close, spending most of the day higher before a late afternoon turn for the worse sent the index lower. We will discuss what has happened for the past 12-months in the weekend report, but in short it has been a good year for the resources and a poor year for the banks – watch out for the weekend report on Sunday.

Overall today, the index finished down 20 points, or -0.33%, to close at 6194.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Monadelphous Rated New Buy at Wilsons; PT A$16.20

· Ausdrill Rated New Buy at Wilsons; PT A$2.80

· NRW Holdings Rated New Buy at Wilsons; PT A$2.50

· Mastermyne Reinstated at Wilsons With Buy; PT A$1.70

· Austin Engineering Rated New Buy at Wilsons; PT A$0.40

· Western Areas Upgraded to Neutral at UBS; PT A$3.50

· Nearmap Rated New Buy at Moelis & Company; PT A$1.43

· Oil Search Downgraded to Sell at Morningstar

· Woodside Downgraded to Hold at Morningstar

· CSL Downgraded to Neutral at JPMorgan; Price Target A$195

Week in review; This week saw the energy names push higher thanks to America’s efforts to limit the purchase of Iranian oil. Healthcare and industrials pulled back after some recent outperformance.

On a stock level, Australian Pharmaceutical rallied after moving to acquire Clearskincare Clinics, while Northern Star and Afterpay pushed higher on broker upgrades. Brokers weren’t as kind to Bellamy’s, which eased on Morgan’s downgrade while Platinum edged lower despite no news flow - seemed like money was leaving Platinum to join Perpetual.

OUR CALLS

No trades in the MM Portfolios today

Have a great weekend

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here