Why is Commonwealth Bank (CBA) down $10!

Commonwealth Bank of Australia shares dropped more than 5%, the most since Aug. 13, after the lender said its headline net interest margin (NIM) narrowed in the first quarter due to the mix effects of strong growth in lower yielding liquid assets.

The Bank grew its home lending and household deposits by more than the average of all banks in the September quarter, helping it to deliver an unaudited cash profit of $2.6 billion for the first three months of its financial year but investors focused on the NIM, sending the stock lower while its other “Big Four” peers rallied.

The first-quarter profit statement highlighted the lender’s rich equity valuation and title of the world’s most expensive bank. The stock dropped as much as 5.9% in Sydney trading, paring this year’s advance to ~8%. A reduced headline margin offset more signs of growth in lending to businesses.

- Unaudited cash profit climbed +2% to about $2.6 billion in the three months to Sept. 30 from a year earlier.

Bloomberg Intelligence analysts now expect the margin to fall further and is tipping a drop in its 2026 full-year profit – not an ideal back drop for a bank trading ~40% above its average 5-year valuation.

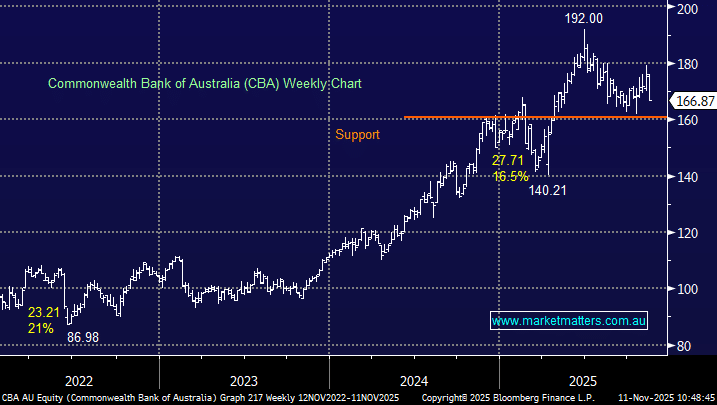

- We are unlikely to be tempted by CBA while its trading above $150.