Sandfire Resource (SFR) – A pureplay on surging Copper (Cu)

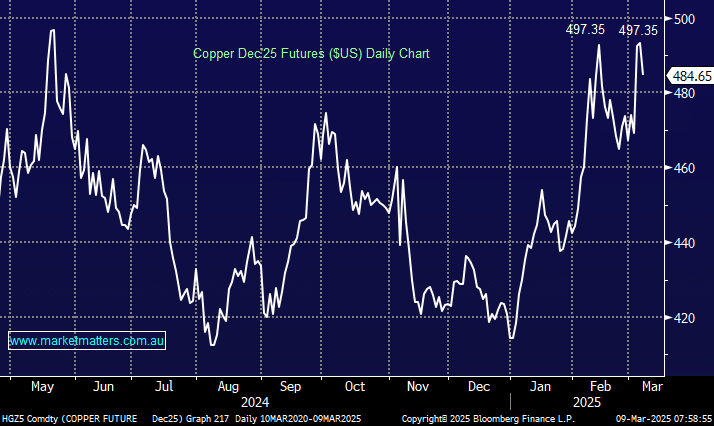

Copper (Cu) has advanced almost 20% from early January lows, with further gains looking likely this month. Cu is a vital commodity for global electrification in the years ahead, whether you’re a believer in AI and/or EVs. The big issue is the limited future supply. With the US importing around 40% of its Cu to satisfy demand from South America, Mexico, and Canada, the industrial metal is in the eye of the storm of Trump’s tariffs. The big-picture goal behind tariffs is to lift the domestic supply of Cu. There is a plentiful pipeline of mining projects within the U.S. However, the main problem is gaining permits, and even if projects were fast-tracked, it would be ~5 years before US production substantially increased.

- It is 50-50 whether Cu will sustain gains above $US5.00, as the next Trump tweet could change everything.

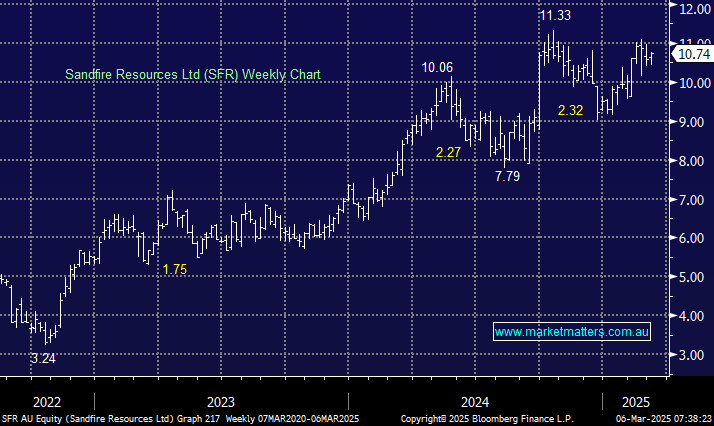

SFR has tracked the Cu price closely through 2024/5, and if we are correct, it should post fresh highs in the coming week (s). However, as we certainly know by now, commodity stocks are cyclical in nature. Although we are bullish toward Cu in the medium term, it should be recognised that the stock has already experienced three pullbacks of around 20% in the last few years. Hence, as we have done over the previous few years, we are not averse to selling/trimming SFR into strength or buying dips.

- We will reconsider our SFR position into new highs above $11.50. MM holds SFR in its Active Growth Portfolio.