Car Group (CAR) – Car sales bucking the consumer confidence trend

Strong results from Eagers (APE) demonstrated that people are buying cars again despite weakening consumer confidence data, although this month’s rate cut should help. If people are buying cars, other big-ticket items may be on the menu, especially when the uncertainty of a looming election and potential rate cuts by the RBA move into the rearview mirror. Importantly, at the moment, the press is talking about further rate cuts through 2025, which should lift consumer spirits over the coming months.

The ~20% surge by APE on Thursday demonstrated that investors (including MM) had underestimated the new and used car markets’ demand; hence, this morning, we’ve looked at four other companies where revenue is linked to big-ticket purchases by the Australian consumer.

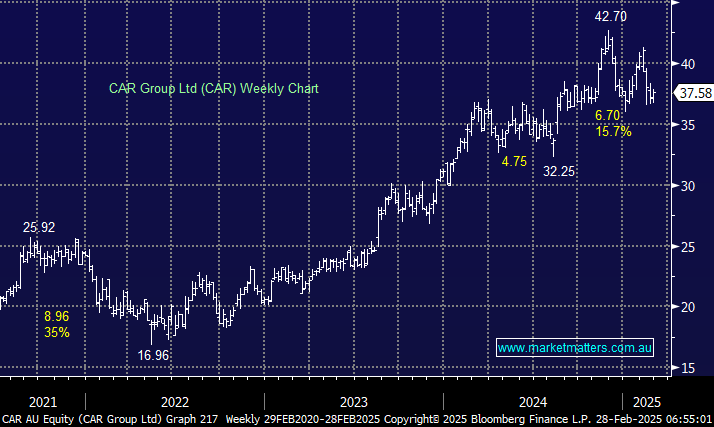

Continuing the car theme from APE, the math is simple: more turnover in the auto market equals increased revenue for CAR. Subscribers know we like CAR but exited the stock on valuation grounds in December; the subsequent weakness has partly addressed this issue, with the stock having already retreated over 15% from its high. Earlier this month, CAR dropped the most since 2022 following a slight earnings miss, especially around the Australian digital vehicle marketplace provider’s US business outlook and higher-than-expected capital expenditure – issues not resolved by Australians buying more cars.

We are considering re-entering CAR, ideally around 6-8% lower, where the valuation will be back to better levels.