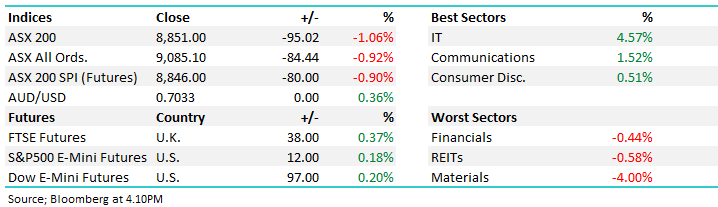

The ASX200 plunged almost 300 points on Monday as global equity markets continued to panic that a recession was imminent for the US and the rest of the world would follow suit. Nobody felt the pain more than Japan following the BOJ’s rate hike last week; the Nikkei was down a staggering 12.4%, its worst day since “Black Monday” in 1987, wiping out all of this year’s gains in one fell swoop. We believe the unwinding of the “Carry Trade” has been the catalyst that has ignited the current volatility – more on this later. Market sentiment has turned on a sixpence as reduced liquidity collided with the perceived increased risk of an economic slowdown; cash has become the asset class of choice for many investors, i.e. if in doubt, get out! Everything from stocks, gold and Bitcoin, has sold as “risk off” ruled dominated over recent days.