Hi Liz,

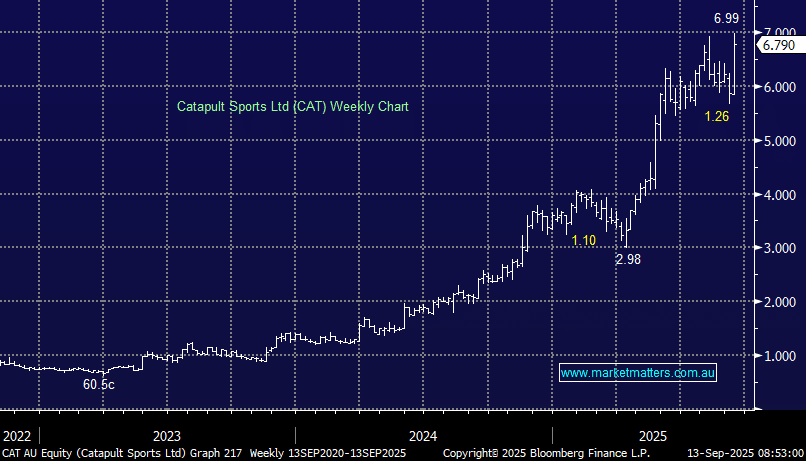

CAT recently surged to new highs after the company announced it continues to see growth in FY26 contract value, free cash flow and margins – a nice trifecta. CAT’s FY25 results showed strong momentum, with revenue up 19% to US$116.5 million and SaaS now accounting for 94% of total income. The company delivered record free cash flow (US$8.6 million), narrowed its net loss, and exceeded US$100 million in Annualised Contract Value (ACV), supported by high customer retention and growing cross-sell.

- With improving margins and a focus on profitable SaaS expansion, CAT enters FY26 with positive operating momentum and a solid outlook.

- Its market cap of $1.9bn might seem lofty while it’s not making money but its set to turn this dial in 2027, and they do have a lot of optionality with their platform, to plus in other revenue generating options, once the customer in ingrained on their platform.

While it’s always tempting to profit after a stock has run so hard we are remaining patient for now, especially as CAT has a good chance of entering the ASX200 when we get the next rebalance which would bring in index flows. We think CAT has a good chance of breaking out, at which point, we would look to trim our position, but not sell it entirely.