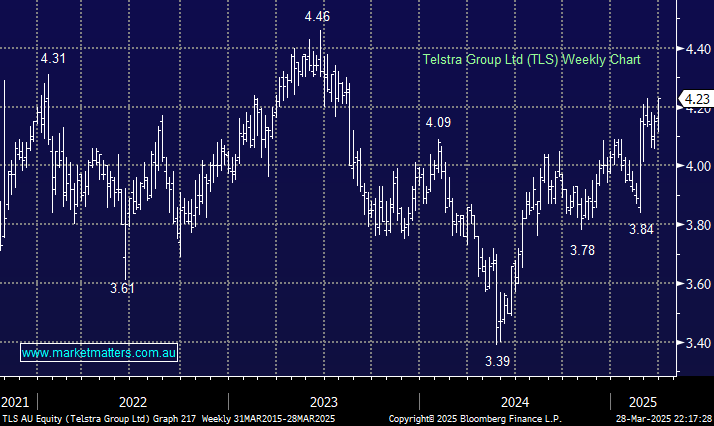

Your view on Telstra (TLS) and Murray Cod (MCA)

Dear MM Team, Recently you said that the 'boring' infrastructure stocks such as APA , ALX etc. will probably out perform the 'sexy' high tech and resources stocks due to tariffs, general fear, and many unknowns. I agree with this. I notice there is little mention of Telstra these days. Although I personally dislike the company one must take emotion out of financial decisions as much as possible. Has TLS shot it's bolt or is there room for further growth and dividends with this company? A couple of years ago I was a BIG fan of aquaculture stocks. This has changed. You said of all the aquaculture stocks I inquired about that Murray Cod had the best shot due to it's above ground farming plus the uniqueness of the fish and it's millions of years of evolution in Australia. I still see a great future for this stock , but, the story always is 'very soon' from the company. To me they should be making money hand over fist NOW. How do you view the company and it's management today? Thank you for your ever wise assessments. Octagenarian