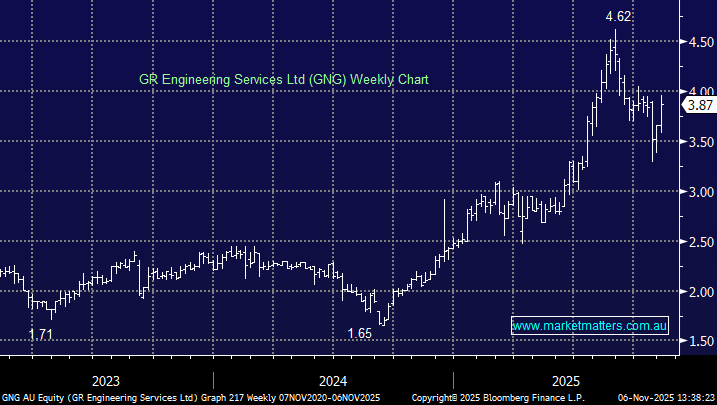

Your thoughts on GR Engineering Ltd (GNG) and AGL Energy Ltd (AGL)

Dear Esteemed Team, I am becoming more fearful of a severe downturn in the economy. Despite my tendency toward greed, I am leaning more and more to defensive stocks and not worry about 'missing out' on massive profits in AI and other hi tech sectors. I notice you have AGL in your Income Portfolio . It has gone down a good bit the past few days which surprises me. I would see this as a good defensive stock with a good fully franked dividend. I notice they have only just re-introduced the 100% franking. Is this likely to continue and is it likely to do well as times get tougher. GNG looks like a nice small/medium cap that you covered a few months ago and spoke well of it. Is GNG likely to thrive in hard times? Often mining services companies are the first things cut when the going gets tough. Are they likely to maintain their high fully franked dividend? Thanx once again for your always wise counsel . Octogenarian