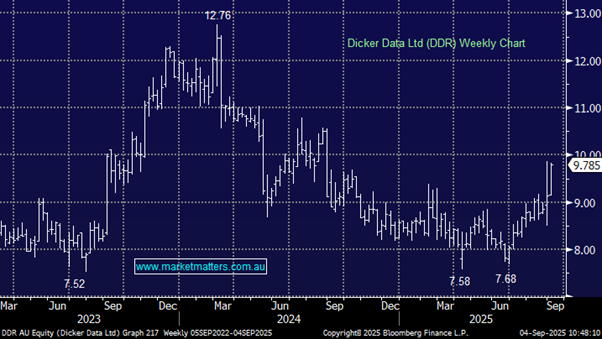

Your thoughts on Dicker Data (DDR) and Deterra Royalties (DRR)

Hello Esteemed Team, DDR has had some violent price swings recently , but, is now really doing well. You have them in your growth portfolio as high risk. Has that risk lessened and do you see further price growth and increased dividend growth? Are yo thinking of increasing the percent of DDR in your growth portfolio? DRR is trying to diversify. Do you see them maintaining high yields and as they pursue their goals? Are they going the right direction? What are the risks , if any , you perceive? Thank you, Octogenarian