Hi Ross,

Like yourselves we love companies where management have “skin in the game” and its one of the reasons MM often talks about “insiders” both buying & selling. However, we must adopt a balanced approach to investing i.e. not every company where directors own large portions of the business are successful even if they by definition are striving to perform.

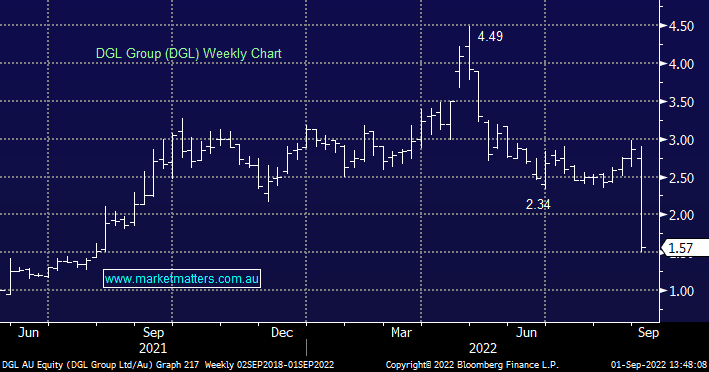

This week has seen DGL almost halve after the logistics company delivered their FY22 results, while we’ve not owned this stock in the past and don’t follow it that closely a few things stuck out to me in the result. Firstly, revenue more than doubled in the past year but profit fell. They had low cash flow conversion which basically means booked income is not directly translating to cash in the bank. Not always an issue but it can imply some creative accounting, which is more important when companies have made lots of acquisitions over time, essentially there is more scope for accounting trickery to take place and a sign of that is via poor cash conversion. As I said before, we are not close followers of this $425mn business but value does look interesting ~$1.50, although some more understanding of their financials would be suggested.