Hi Adel,

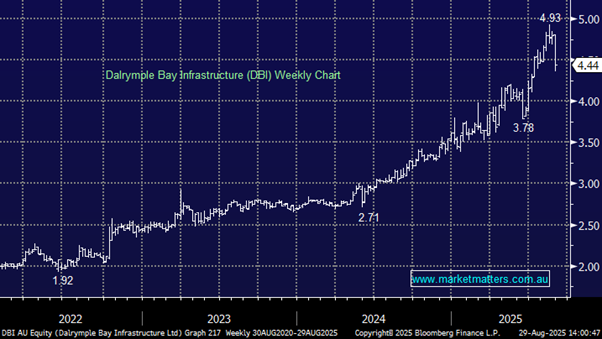

DBI has extended its recent pullback to ~12% this week following its 2H result which overall was solid:

- Revenue for the six months to 30 June was $396.4m, comfortably ahead of consensus at $377.6m and up from $377.9m last year.

However, earnings per security (EPS) came in at 8.7c, a healthy lift on the 7.4c delivered a year ago but just shy of the street’s 9c expectation. Looking further ahead, DBI guided to distribution growth of 6.5%, underpinned by rising revenue and flat cost growth.

- We continue to like DBI, holding it in our Active Income portfolio.

The pullback towards $4.40 feels overdone and an ideal buying opportunity to us, especially for income with the stock forecast to yield 5.5% part-franked over the coming 12-months just when the RBA are expected to cut interest rates.