Hi Guys,

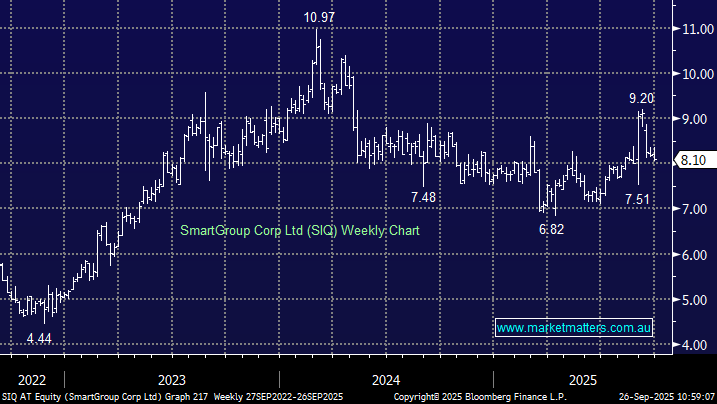

SmartGroup (SIQ) dropped out of the ASX200 this week as part of the quarterly rebalance of the index. It’s never good news but also not necessarily a disaster, but by definition it does demonstrate market underperformance in the vast majority of cases. In the short-term, this would have led to selling of the stock, explaining it’s recent underperformance, though we still like their direction, valuation and yield, noting our 4% target weighting.

Moving forward removal from the ASX200 can lead to less visibility and analyst coverage but as always, the performance of the underlying share price will be dictated but earnings in the medium to longer term.

- We remain long SIQ in our Active Income Portfolio for yield following their solid 1H report last month.

The question on AI would take a few MM morning reports to answer for this rapidly evolving market which encompasses data centres, energy and commodities as the implications of this new industry reach far and wide. The ASX does have limited exposure to this huge theme, and we think skewing internationally makes more sense. For ASX listed vehicles to do that, ETFs are a good place to start:

- We like the BetaShares Asia Technology Tigers ETF (ASIA) for solid, broad-based Asian tech exposure.

- We like the BetaShares Global X Fang (FANG) ETFs for exposure to top US AI / tech heavyweights.

However , to answer your question around 3 ASX stocks specifically:

- Goodman (GMG) for Datacentre exposure

- Paladin (PDN) for Energy

- Dicker Data (DDR) for SME technology refresh cycle

If we were to buy one stock irrespective of exchange as an A1 ‘bet’ it would be Microsft (MSFT US).