Hi Tom,

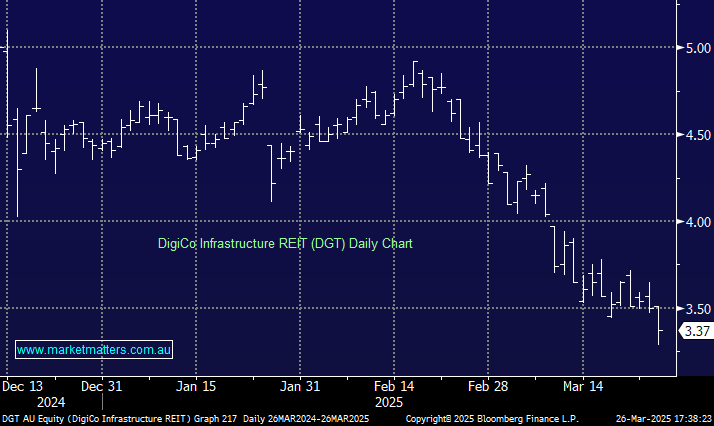

The weakness has actually played out across the whole data-centre/AI space. DGT has fallen over 30% from its February high but its in good company, over the same period NXT is down 20%, Goodman Group (GMG) 20% and Nvidia (NVDA US) 16% to name a few. We believe the declines have been a simple reversion of sentiment as a certain frothiness came out of the space.

In terms of DigiCo REIT, the forecast annualised distribution yield is 4% for the period from 18 December to 30 June 2025. DGT intends to determine distributions semi-annually. The first distribution will be a pro-rata amount based on the period between 18 December and 30 June. We don’t see this being in danger short-term, given the nature of their contracted revenue, but anything is possible and the share price weakness does reduce the appeal of raising money by issuing equity.

They do have big growth plans which requires capital. In recent times there has been a big appetite from the market to fund this though share placements. We can see from the share price, the appetite is no longer there, and this does increase the risk of a dividend reduction/pause in the future. We prefer HMC over DGT at this juncture.