Hi Paul,

These are two stocks that have caught the attention of subscribers of late as they fail to keep pace with the ASX200 punching to new highs:

Sigma Healthcare (SIG) – as you say it’s been tracking sideways since June, anchored to the $3 level post the merger with Chemist Warehouse. We believe the stock is largely recession resistant but it’s not immune as discretionary product lines and profit margins could wobble in a deep or prolonged downturn, but it’s unlikely to see a severe earnings collapse.

- Pros – Pharmaceuticals are non-discretionary, health spending is defensive, private label and lower cost appeal and a broad national footprint insulates SIG around on any one location or demographic group.

- Cons – The front-of-store (discretionary) retail thrives on foot traffic & impulse purchases.

Consolidation in the share price is more about supply of stock – large sellers reducing holdings satisfies fund managers demand, and the stock stays in a range until this works through. We think it’s a great business, it just needs time to deal with the change over of it’s register. We are neutral towards SIG around $3, however – it’s on our radar for signs the overhang is being depleted.

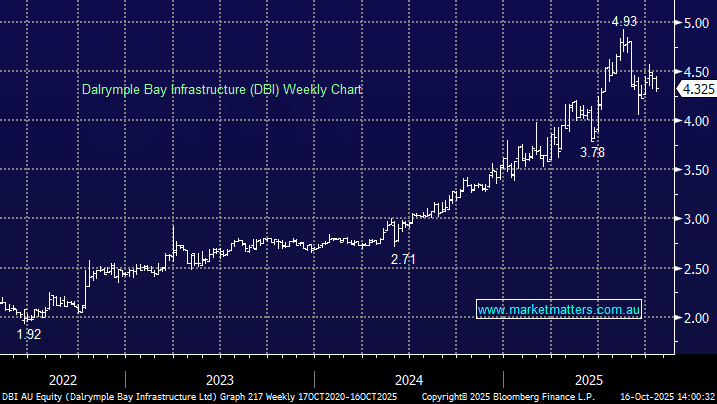

Dalrymple Bay Infrastructure (DBI) – there has been plenty of activity unfolding at DBI in recent months, with its inclusion in the ASX 200 index and the complete sell-down by its largest shareholder, Brookfield. The combination of reasonable earnings and mid-single-digit distribution growth, underpinned by take-or-pay contracts, is supportive of DBI’s role as a solid dividend-paying infrastructure stock.

We don’t think DBI is in imminent danger of going seriously backwards because its core business is infrastructure with its income coming from a terminal infrastructure charge that is contractually secured, not directly tied to coal commodity price fluctuations, making it more stable than purely upstream coal producers.

That said, if the weakness in global steel markets deepens, and if Queensland mines cut back production or delay projects, that could test counterparty strength, trigger renegotiation risk, and put pressure on margins if customers push back or default, but we don’t see this as likely. The medium term outlook for Met Coal (used in steel making) remains solid, in our opinion, but if higher costs do occur, higher volumes are generally the best way to protect margins, and DBI is a beneficiary of higher volumes.