Hi Chris,

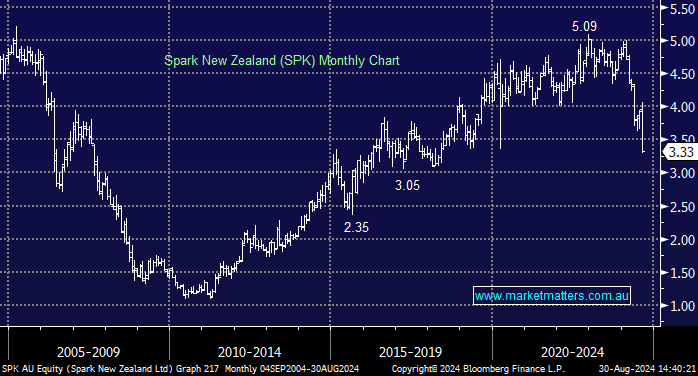

It’s been a tough week/month for NZ Telco SPK, especially when compared to Australian local peers. SPK’s FY24 result missed the mark by a long way as they failed to pivot on costs quick enough for a more subdued sales environment.

- Revenue: NZ$3.86b (down 14% from FY 2023) – mkt was expecting $NZ3.91bn

- Net income: NZ$316.0m (down 72% from FY 2023)

- Profit margin: 8.2% (down from 25% in FY 2023) – this is the key.

- Dividend of NZ 0.14 payable on 4th October.

The miss was largely caused by cuts to public spending and deferred private sector spending weighing on IT services revenue. They are guiding for a slight uptick in earnings in FY25, though we suspect it will take the market some time to believe them!

- We don’t mind SPK as a yield play in the $3-3.15 area, or 5-10% lower.