Morning Dave,

In late October Southern Cross Media (SXL) announced full year revenue was down over 18% to $540m with COVID the major earnings headwind, an ok result considering how many businesses aggressively reined in their advertising through the uncertain times. History tells us that advertisers ramp up spending when the economy is improving hence SXL should see trading conditions improve in the months ahead.

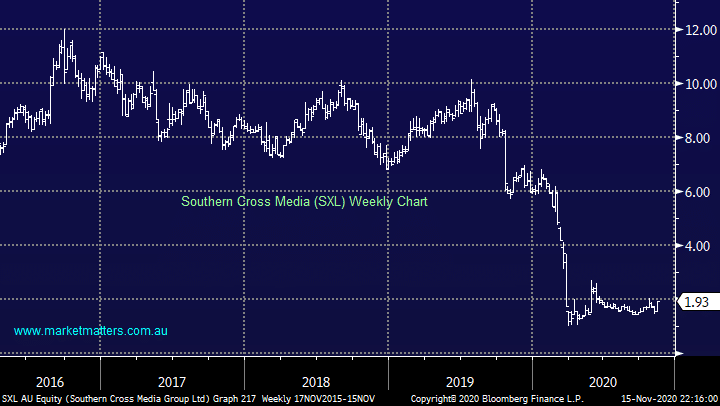

In terms of the recent share consolidation, this is not a ‘bad’ update. They have simply consolidated the number of shares on issue on a 1 for 10 ratio. i.e. for every 10 shares you hold, you now own 1 however the price is now 10 times higher. On current prices of $1.93 the pre-consolidated price would be 19.3c. Companies do this for a range of reasons, however ultimately, it brings their stock out of the ‘penny dreadful’ area of the market without having any influence on shareholder value.

While this is not one for MM, media businesses like SXL are very leveraged to economic recoveries, and if we held, we’d continue to hold to see if they can take advantage of improving conditions.