Thanks Richard,

For those not across the very recent change, I have moved from Shaw and Partners, launching an adjacent brand to Market Matters, called Market Partners, offering bespoke managed portfolios, trade execution and broader wealth management services. I’ll be introducing Market Partners to the Market Matters community in the coming few weeks. After 12 years at Shaw, and with their full support, Market Partners has been created to offer a greater level of independance and alignment with Market Matters. Shaw remains a supportive share holder in MM and we can leverage their national footprint, offices, research and financial backing. Earl Evans and the broader Shaw team have been fantastic, as have our wonderful group of clients as we’ve transitioned into Market Partners. It’s been a goal of mine for the past few years and I’m really excited that it’s now reality. Independence + Pupose = Happiness!

Now onto the question…

Southern Cross Electrical Engineering (SXE) has become a “picks and shovels” data centre company through its subsidiaries (e.g., Heyday, Blue Star, Trivantage), being a major contractor in data centre construction and digital infrastructure. To put the numbers into perspective:

- SXE generated ~$800mn revenue in FY25, including ~$100mn for DC work.

- The company recently announced a strong pipeline of over $500mn in tenders for future work including data centre projects.

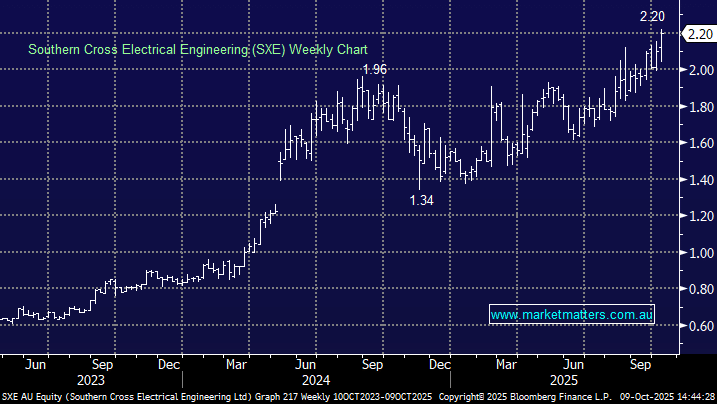

The stocks up ~40% so far this year, trading on the rich side of history, already pricing in further contract wins. The dynamics of their business have changed, with DC construction an enduring growth area over the coming years. In hindsight, we should have pressed the button on this one, however for now, we are not inclined to chase the strong move in the share price – the stock would be more appealing closer to $2, from a risk/reward perspective, where it’s been trading for recent months.

- We like SXE but aren’t keen on chasing strength above $2.20.

SKS Technologies (SKS) operates in a similar space to SXE in some ways, particularly in technology infrastructure and electrical services, but it’s a smaller, more specialised business with a narrower focus, especially in audiovisual, communications, and smart building systems. This is an interesting ~$500mn business which has more than doubled in the last 4-months after its 1H profit guidance in August exceeded expectations,

- Revenue of $261.7mn for FY25 came in +92% YoY while importantly profit before tax (PBT) came in +15.6% above guidance.

SKS ended the year with cash on hand of $32.5 million, giving it flexibility, and shows the business is generating real cash, not just an accounting profit. We like SKS but the same applies, we are reticient to chase the stock above $4.30, preferring to buy dips (if they occur) back under $4.