Hi Angela,

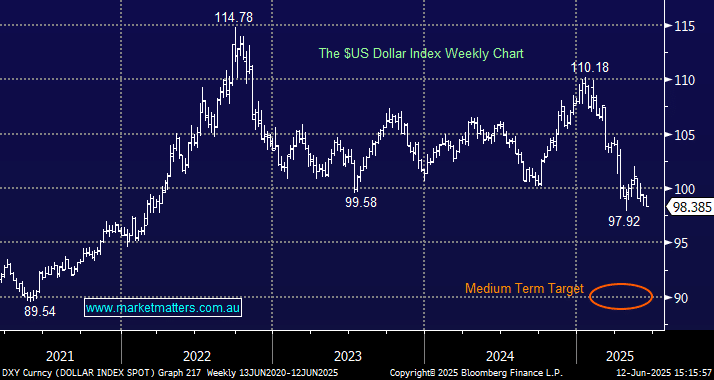

In this rapidly evolving environment $US earnings might be as much of a concern as looming US reform – this week legendary US hedge fund manager Paul Tudor Jones predicted the US dollar would drop by more than 10% over the next year as short-term interest rates fall sharply, especially with President Donald Trump likely to appoint an “uber dovish” Federal Reserve chair to accommodate his growth agenda when Jerome Powell’s term ends next year. Coming back to Section 899:

- Section 899 has passed the U.S. House of Representatives but awaits consideration in the Senate, where significant modifications are anticipated.

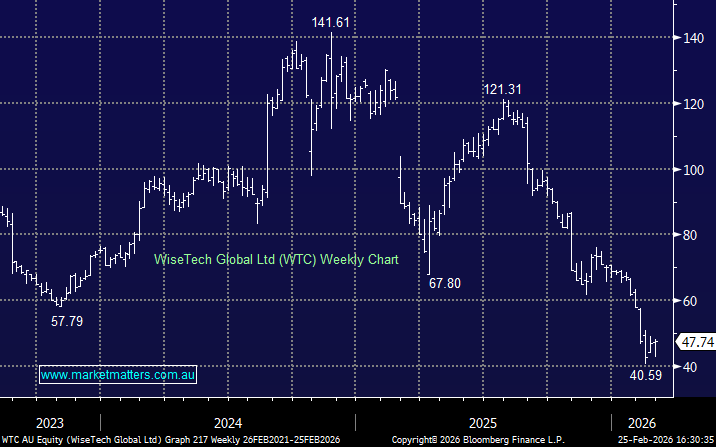

But if we assume it goes ahead as is, it’s likely to detrimental to Australian biotech’s such as CSL and Telix which have significant U.S. operations & are listed on U.S. exchanges, assuming Australia is designated as a “discriminatory foreign country” under Section 899. Time for the Prime Minister to weave some magic:

- This designation would subject their U.S. sourced income a higher U.S. federal tax rate, starting with a 5 percentage point increase and potentially reaching an additional 20% over four years.

This very real risk hanging over CSL and TLX is one of several reasons why both stocks have underperformed in 2025.