Hi Glenn,

QOR is a $840mn Australian-listed global child digital safety and wellbeing technology company. Formerly known as Family Zone Cyber Safety, they provide digital safety technologies for children, offering monitoring, reporting, and education tools. Its platforms—Linewize, Smoothwall, and Qustodio—are used globally, supporting schools, parents, and millions of students with the aim of keeping children safe offline – a huge issue today.

QOR delivered robust Annual Recurring Revenue (ARR) growth and improved margins in FY25, although they still posted a net loss. The company demonstrated strong operational leverage and growth momentum, with profitability and positive cash flow anticipated in the near term.

- FY26 Guidance projects 20% ARR growth and EBITDA margin of 20%.

The numbers look good in this important growth area with Qoria’s largest and most direct competitors in schools being GoGuardian, Securly, and Lightspeed Systems, which dominate student monitoring, filtering, and classroom management in the U.S. education market. On the consumer side, rivals like Canopy, PureSight, and Forcefield compete with Qoria’s Qustodio in parental control and online safety apps.

QOR’s integrated approach, combining school and family safety solutions, sets it apart in this competitive landscape.

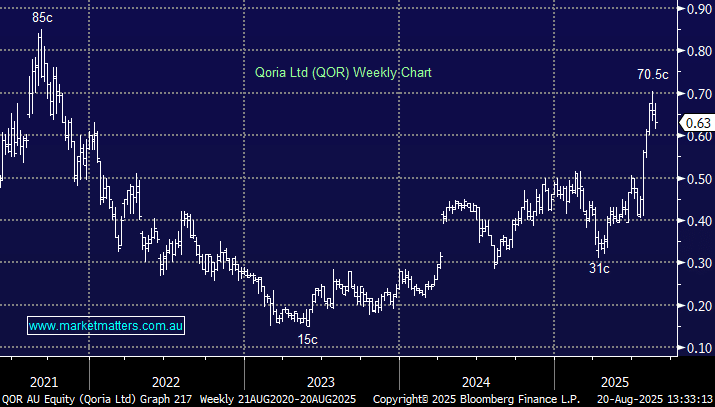

- We like QOR around 60c as it starts to turn the dial towards profitability.

We have already witnessed with $10bn Life360 (36) the growth in protecting children with the online threat arguably the greatest growing concern. QOR is in the right market and should flourish if it can stay ahead of the pack.