Hi Peter,

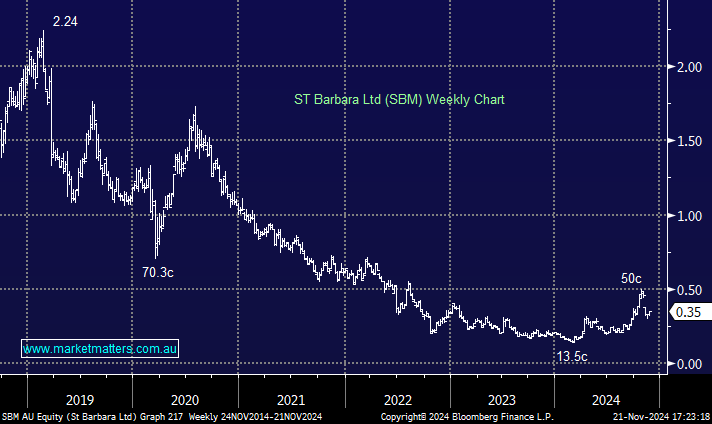

We don’t own SBM hence our comments are from the outside looking in so to speak:

- SBM closed on Thursday at 35c and the $10mn SPP provides Eligible Shareholders with the opportunity to purchase New Shares at an Issue Price of $ 0.38c Per New Share, the maths don’t add up to us!

SBM is raising $110 million in total to accelerate the expansion of its Simberi Sulphide project in PNG. This involves a $100 million placement and the mentioned $10 million SPP. The funds will support infrastructure upgrades, including a new ball mill, a wharf, and additional development at the mining site, aiming to bring forward production by up to five months. The expansion is expected to increase annual gold output to over 200,000 ounces starting from FY28, making it a crucial part of SBM’s growth strategy.

- SBM projects that the All-In Sustaining Cost (AISC) for its Simberi Sulphide expansion project will range between US$1,000 and US$1,200/oz from fiscal year 2028 through to 2034, a cheap producer in a few years time if alll goes according to plan and gold prices remain strong.

MM remains bullish towards gold stocks but we would rather stay with the strength such as Evolution (EVN) or Northern Star (NST).