Hi Scott,

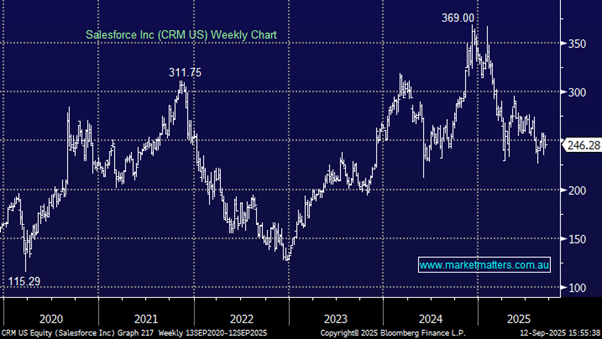

Salesforce (CRM US) has endured a lacklustre few years, especially relative to the broader gains in the S&P 500. While the stock has seen bouts of volatility, it’s essentially flat over the past 3–4 years. As you noted, it’s now trading around 45% below its average 5 year valuation — a clear sign that the market remains unconvinced about the next phase of growth for its cloud-based software and customer relationship management (CRM) platform.

While Agentforce is seen as giving CRM strategic optionality, it’s being positioned as a growth lever in the AI / Data Cloud story. However, material revenue contribution is not expected until FY27 due to adoption and deployment taking time. It has some momentum but while it looks on point for organisations heavily invested in Salesforce already, it’s unlikely to make customers switch from the likes of HubSpot (MM uses) which has already introduced AI Agents under its “Breeze Agents” / “AI agent” ecosystem – which is what they need to standout and deliver real growth.

- The win of the US contract is symbolically important for Salesforce as it shows they can compete with Palantir but their bid was much lower hence the markets is far from convinced that it plants a meaningful flag moving forward.

In other words, Agentforce might only let CRM keep up with the competition as opposed to grow. We are neutral towards CRM with AI set to change the CRM landscape dramatically in the coming years, and unless they continue to spend lots of money innovating, their high cost offering may struggle.