Hi Mark,

This can be a great time to buy oversold companies although we also have to be cognisant of whether the overall dynamic of the business have changed, just because a company was trading significantly higher a year ago doesn’t mean it will again:

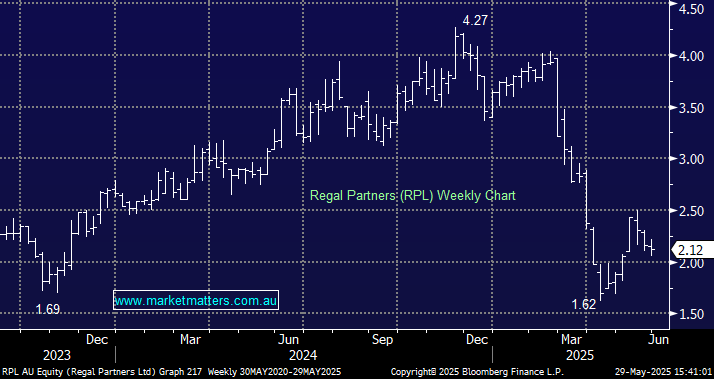

Regal Partners (RPL): fund managers live and die on performance, with RPL Regal’s FUM decreasing by 8.3% in the first quarter of 2025. This decline was primarily due to negative investment performance highlighting volatility and risk in their strategies. They are also on the expensive side relative the amount of money they manage, and that has traditionally been justified because they generate higher fees than many other managers based on better performance than most. When performance struggles as it has, then the future ability to generate above average fees/earnings relative to FUM is called into question.

That said, we like the fact that RPL has moved in private credit which we discussed in March, as it takes the company down the path to being a multi-strategy investment manager but through 2025/6 better returns are required to generate inflows and revenue from the company’s aggressive fee structure.

- We like RPL ~$2 with performance the key to Phil Kings $715mn fund business. History suggests they’re fortunes will turn.

IDP Education (IEL) has endured an awful few years due to a combination of regulatory challenges in Australia, the UK, and Canada. In February 1H25 earnings came in below market estimates with noticeably underwhelming volumes across all business segments. The education provider posted a 15% decline in their student volumes and guided international student volumes down by 20-30% in FY25.

- It’s hard to know if/where to catch this falling knife but it’s difficult to imagine the regulatory news deteriorating further although governments are involved. The companies profitable and getting interesting below $8, especially if we see aggressive “tax loss” selling.

Also, with the US about to start revoking Chinese student visas this could be a great opportunity for IEL.