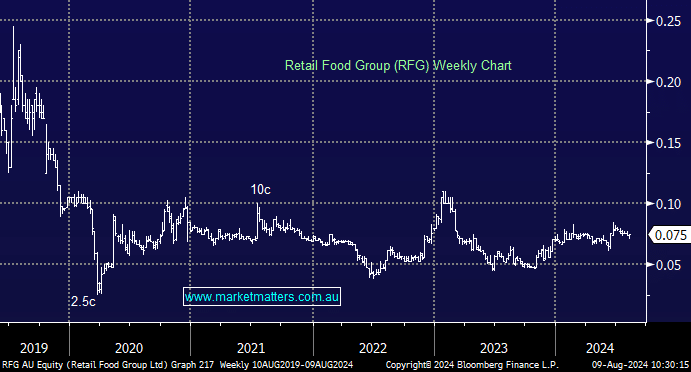

Retail Food Group (RFG)

Hi Market Matters Team. Two questions in three weeks - I must have too much time on my hands! I noticed in Wednesday morning's report that you have RFG in the Hitlist for the Emerging companies Portfolio. Having been badly caught back in 2017 by the RFG debacle after the shock Melbourne Age expose of the companies business tactics (I have never understood why the class action legal sharks never seemed interested in this episode) , I would be interested to have a better understanding of why MM see RFG as a good bet at this point. I can see that management been talking up a turn-round story for years now, and I accept the sentiment 'never say never', but their share price is still single digit cents and has been since they crashed in flames. What does MM see RFG achieving in terms of share price, and over what period, I wonder? As always, thoroughly enjoy your reports. Regards, Karl Baker