Hi David,

A few parts to this question but you’re right the market definitely does recognise the long-term quality/value add with SOL. However, moving into the ASX50 usually has significantly less impact on a stock than joining the ASX200.

- The SPDR ASX200 ETF (STW) is more than 8x larger than the SPDR ASX 50 ETF (SFY).

The top three holdings of the “old” SOL from an approximate valuation perspective are:

- TPG Telecom (TPG) ~30%, Brickworks (BKW) ~24%, and New Hope (NHC) 14%.

However, SOL and BKW are merging to simplify their long-standing cross-shareholding and create a single, more diversified investment ~$14bn company called TopCo. The deal aims to unlock value, improve transparency, and strengthen financial flexibility, with Soul Patts shareholders owning about 72% of the new entity. Once the merger is finalised, TopCo will be renamed Washington H. Soul Pattinson and Company Limited and will revert to the old ticker SOL.

- After the merger, ownership is expected to be roughly: 72% for existing SOL shareholders, 19% for BKWs, and 9% for new shareholders who participate via capital raising.

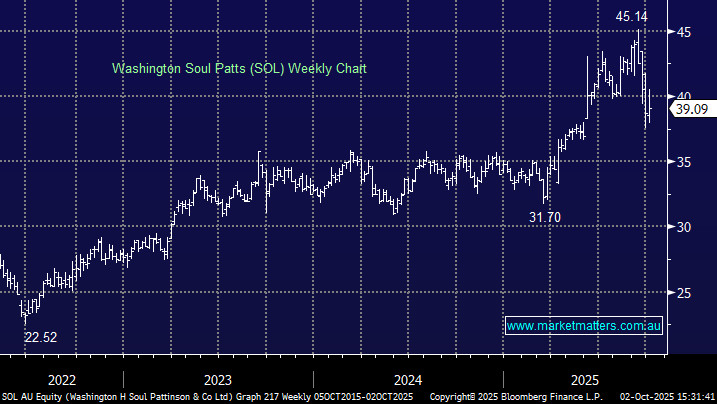

Recent weakness is likely driven by shareholders of BKW taking advantage of the ~10% premium received in the deal.

- We like SOL after its almost 15% pullback back under $40, and we think the new structure will give them a great ability to take advantage of opportunities, without the complication of large embedded tax consequences, which has been the case in the past.