Hi Richard,

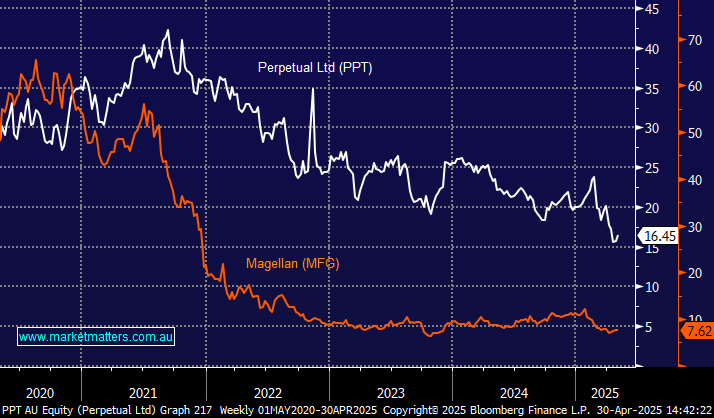

An excellent and well-timed question, our first thought was about crowded trades, a number of whom have come an absolute cropper in recent months & years, from lithium/ESG over last few years to high-value popular stocks in April and the Magnificent Seven over recent months. We don’t believe ETF’s will see the end of Managed Funds but the managers will need to perform and charge reasonable fees and there lieth the issue with MFG, whereas PPT made some expansion mistakes:

- Magellan (MFG) has fallen ~90% courtesy of poor performance, high fees and the departure of headline founder Hamish Douglass which combined to cause mass withdrawals. Lower Funds Under Mgt. (FUM) = lower fees etc.

- Perpetual (PPT) has fallen ~60% for more corporate level issue, following its acquisition of Pendal Group for ~$2 billion in 2022, which they’ve written down materially. Then when PPT planned to sell its wealth management and corporate trust businesses to KKR for A$2.2 billion the ATO raised concerns, leading to an unexpected increase in estimated tax liabilities from $106–227 million to $493–529 million – when it rains it pours, we covered the PPT saga a number of times last year.

Both fund managers look good value today and we added MFG to our Income portfolio in March. However, for growth we prefer GQG Partners (GQG) and Regal (RPL) as an aggressive play.

In answering the more philosophical question about active vs passive managers, we have a few thoughts.

- Active managers must generate better performance to attract FUM. When they don’t, funds leave.

- The more passive the market becomes though, the easier it becomes for active managers to actually add value, and the pendulum will swing back towards active.

- Passive flows distort indices and create risks. Buying passive means you buy more of the stocks that have gone up in a given index because their weighting increases, which makes little sense to us.

- While active managers need to add value, this can come in more forms that just straight returns. For example, an active manager that keeps pace with the market but takes lower risk than the index is adding value.

- A manager style can suit an individual investor style better i.e. an investor can buy into the managers philosophy and provide value as a consequence.

- Passive is clearly here to stay, and naturally, some active managers will fall by the wayside as the pool of capital gets dispersed. But true active managers, that take a different path to the index, that stay small and nimble, we think have a great future.

- The issue for the larger funds is they charge active fees but generally look and feel a lot like a passive fund, and this is the challenge for companies like MFG and PPT.