Hi Glenn,

A very complex question. If major economies roll back on Net Zero and keep Chinese wind/solar at arm’s length, the US likely enjoys comparatively lower power costs (cheap gas + IRA build-out), while Australia risks structurally higher prices unless we accelerate firmed supply (batteries, gas peakers, life-extensions for coal) and transmission. That split would reshape competitiveness across energy-intensive industries.

For certain companies, high electricity prices are a real threat. For those in energy‑intensive sectors, profit margin compression is likely, possibly even viability issues if contracts expire and no replacement deals are affordable. However, many ASX companies either already have partial hedges, some scale/power usage contracts, or ability to pass on costs, which should cushion the impact to earnings. But for some in steel, aluminium, data centres, cement etc., there’s a nontrivial downside risk if energy prices do not moderate.

- Industries in the spotlight are Mining (especially energy‑intensive mining / ore processing), data centres, chemical plants, cement, and building materials plus supermarkets with large refrigeration + lighting + HVAC loads.

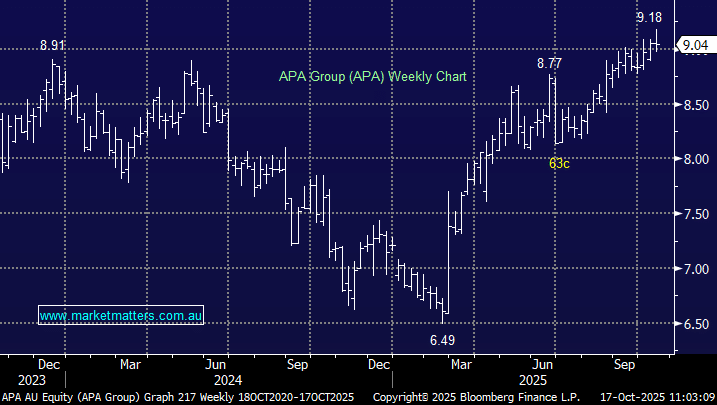

There are fewer beneficiaries, but the standouts are energy infrastructure companies that pass-through contracts, inflation-linked pricing such APA and AGL. Also, some renewable businesses should become more viable, such as battery + solar storage developer Genex Power (GNX) and Infratil (IFT) who owns renewable assets across ANZ and the U.S.