PME results / portfolio weightings

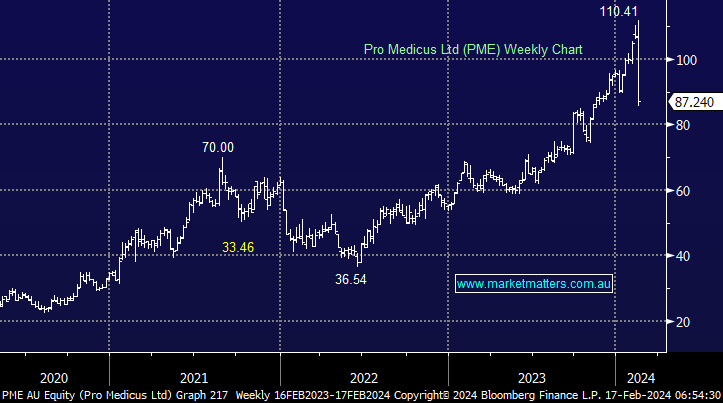

Thoughts on PME after the recent pullback on HY24 and analyst downgrades flowing post. Been a long time observer and frustratingly continuously missed the boat. If they continue to push out 25-30% EPS growth rates over the next 3-5 years do you think this pull back is a worthwhile point to start building a position - say averaging in over a few months? Also on portfolio weightings how do you determine weightings? Say you choose to allocate a max portfolio weighting to a stock in a portfolio of 5-7% how would you approach allocations when 'accumulating' a stock - assuming your conviction means you would hold this for the medium to long term. Would you do in increments of 3-4 allocations over 6-12 months to build the position?