Hi Anne,

Palantir Technologies (PLTR US) for subscribers unfamiliar with the company is a $450bn software company specialising in big data analytics and AI. The company has a few revenue streams:

- The Government remains Palantir’s largest revenue source. In FY24, it accounted for approximately $1.6 billion, representing about 55% of the company’s total revenue. This included contracts with U.S. federal agencies such as the Department of Defense, Homeland Security, and the Department of Justice.

- Palantir’s expanding presence in industries such as healthcare, energy, and manufacturing generated approximately $1.3 billion, accounting for about 45% of total revenue.

The introduction of Palantir’s Artificial Intelligence Platform (AIP) has positioned the company at the forefront of the AI revolution. AIP allows organisations to leverage generative AI within their own data environments, facilitating advanced analytics and operational efficiencies but this is space that’s going to be very competitive with only a few enjoying significant ROI.

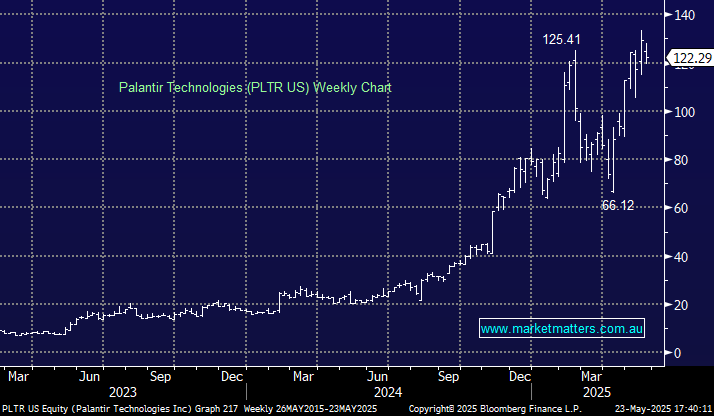

Palantir is an impressive company as the numbers above illustrate trading very close to all-time highs, having run from ~$US20 this time last year to $US130. It’s on a very stretched valuation, however, AI is clearly the future and PLTR is a company at the forefront of it. As a guide, they did $US2.9bn revenue in FY24 and this number is expected to grow to $US5bn by FY26.

- We think this is a great story, but we would be reticent to chase the stock into new highs above $US130.

Our International Equities Portfolio we think is filled with good ideas across a diverse range of sectors. In the tech space, we think Microsoft (MSFT US) is a core portfolio holding, adding some spice with The Trade Desk (TTD US), while Zillow (ZG US) has also pulled back to an interesting area ~$US65 where the risk/reward is appealing. Snowflake (SNOW US) in the AI space is one we no longer own, but we’ll cover this in coming notes, as they’ve worked through some of the issues that hurt them last year, and it starting to look interesting again.