Hi Michael,

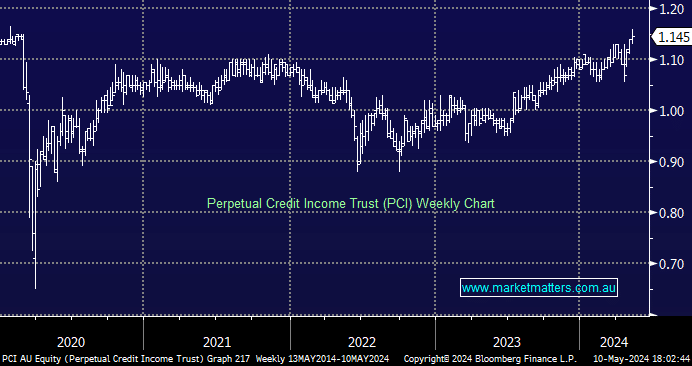

The already listed Perpetual Credit Income Trust (PCI) $1.145 is managed by Perpetual themselves that is lower risk than PCX (shown via a lower benchmark – RBA Cash Rate + 3.25% p.a.), is lower fee (0.88%) vs PCX and while it holds a portfolio of approximately 50 to 100 assets, making it diversified, but it’s probably less so that PCX.

The Pengana Global Credit Trust (PCX) which is listing soon is a fund of fund structure, whereby Pengana themselves simply create a portfolio of external manages (with the help of asset consultant Mercer). They add value through manager selection and importantly, getting access to managers others cannot.

They change 1.25% themselves, then the fund managers they invest with charge a fee, plus there is a performance fee attached that is 20% above the hurdle rate of the RBA Official Cash Rate + 6% p.a – which at the moment is 10.35%, so you can see it’s going to be slightly higher risk than the more vanilla PCI product because they would want to earn performance fees. They also have a fairly innovative mechanism where holders could tender their shares back at NTA if the price on market was trading below NTA. This is designed the try and address the issue of things trading at discounts on the ASX, although it is limited to 5% of issued units so the jury is out on how that will go.

Both are good managers, we quiet like both products, with Pengana being at the higher risk, higher return end while the Perpetual Trust is a little more vanilla in nature.