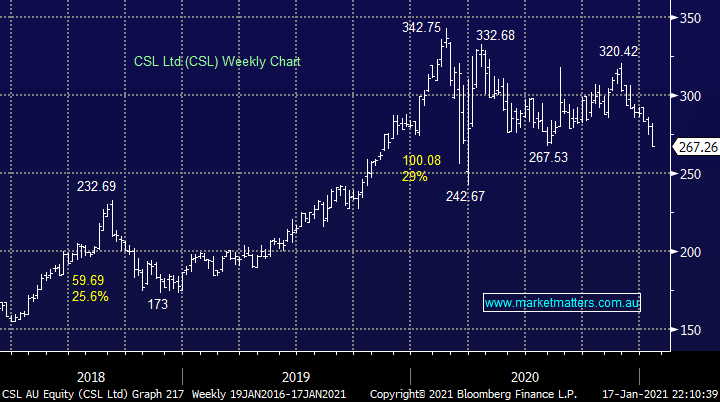

Our view on CSL

“Thank you for the weekend report. You mentioned that we should be careful of inflation but did not say how we should watch for it or how to be prepared. What companies would benefit from a high inflation environment? I’m wondering what your thoughts are of CSL today. I bought it a few months ago with the view that they’ll be manufacturing the AstraZeneca vaccine locally but whilst it initially performed strongly it has now below what I paid for it. Also, your thoughts about the IT stocks- Xero, Altium and Appen specifically.” - Best Regards Kenneth C.