Hi Mark,

Thanks for the positive feedback, always nice to read.

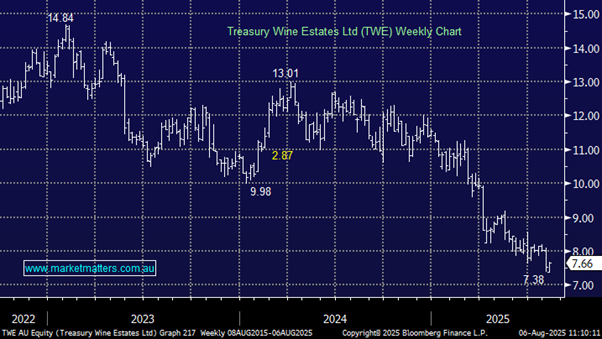

As for TWE it’s delivered more negatives than positives over the last few years with the share price down almost 50% from its 2023 high, while the ASX200 forged ahead. Their recent trading update in June looked mildly supportive but buyers failed to materialise, and small downgrades ensued.

- Management expects full-year earnings of roughly $770 million, marking a +17% increase on 2024.

- A share buyback of up to 5% of issued capital was announced.

The stock continues to appear “cheap” even with its strong performer Penfolds, future growth expected to slow to low/mid double‑digits, given softer demand across the U.S. market. We feel the stock needs a catalyst to re-rate and an until then MM is likely to remain on the sidelines, but we are conscious that its trading materially below it’s usual earnings multiple.

- Analysts still like TWE with 6 Holds, 6 Buys and 3 Strong Buys but the ‘Tapes” not listening!