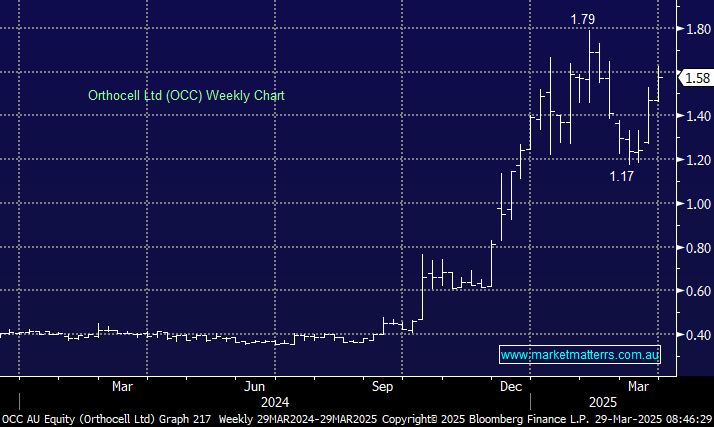

Orthocell Ltd (OCC)

Following on your favourable appraisal last week of this company, I wonder if you have a method of forecasting the share value based on the addressable market of its key products and the number of shares on the market. The OCC has suggested a US market value of $1.6bn if approval is given. OCC has 200m shares (I believe). This would imply revenue per share of some $7 per share. If costs can be managed, a $5-7 share price wouldn't be out of the question, would it?