More about the RBA’s bond buying program

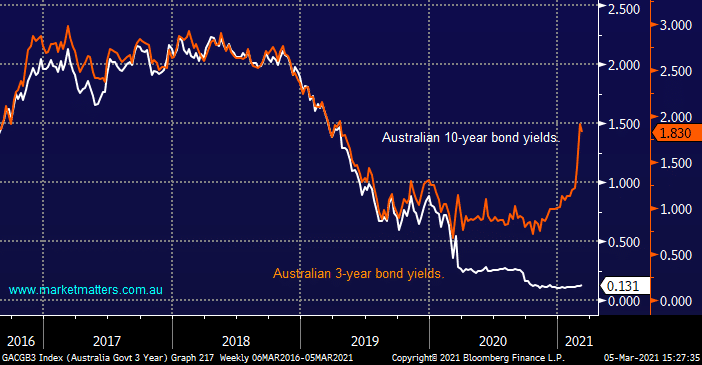

I am interested in receiving a more complete explanation of the bond buying programme of the RBA. The Au Govt is selling the bonds? The RBA (another arm of the Govt) is buying. It is bidding up the price therefore reducing the yield? Correct? Outbidding other buyers? Interesting long term implications for the value of money if overdone. Henry R