Hi Guys,

We have combined two very similar and topical questions into one. Firstly, thank you for the feedback, it’s much appreciated. Our goal has always been to provide real intel on the market and investment opportunities. We certainly don’t get it right all the time, but the team works hard every day to provide a real and transparent service to help members, not dupe them into a subscription with overstated and often cherry-picked claims.

Defence stocks have run hard in 2025, driven by Germany’s parliament voting in favour of unleashing historical levels of spending to boost the military of Europe’s biggest economy and inject its infrastructure with investments worth €500bn in an effort to offset Russia’s aggression towards Ukraine, and President Trump’s threats to leave NATO. We agree with your bullish outlook toward defence through 2025, as does the market, it has already piled into German stocks, driving the DAX to fresh all-time highs this week – this European bourse looks a touch stretched short-term but a “buy the dip” approach looks on point

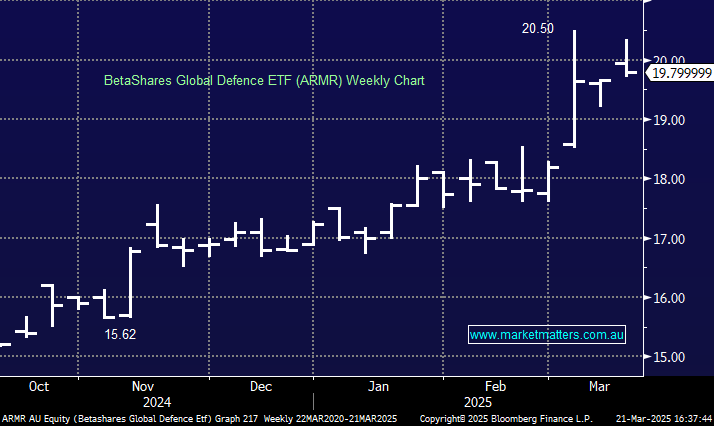

Two defence options on the ASX are the BetaShares Global Defence (ARMR) and the Vancek Global Defence (DFND) ETFs; they are similar to each other, and although they have a relatively small market capitalisation locally, they are liquid as both entities are traded internationally. Their characteristics explain the holdings/exposure, and at MM, we like them both, with the ARMR skewed far more toward the US:

- ARMR: 78% Aerospace/Defence, with 60% US, and 30% Europe.

- DFND: 60% Aerospace/Defence, with 47% US and 35% Europe.

When stocks run exponentially, as investors, we must first decide if the proverbial “goalposts” have moved, as they have with European Defence. However, in most instances, taking at least part of the profits into such moves is often the prudent course of action. We often scale in and out of positions, especially during these sorts of moves – similarly, we are pondering if it’s time to lock in some $$ from gold as the crowd becomes super long & bullish.

NB If we don’t believe a fundamental shift has occurred, we will just take our money and move on.

- We like both of these ETFs, but they have run hard, as you alluded to, and we would be inclined to accumulate into dips – the ARMR ETF looks best to us around $19.25.