MFG Departure

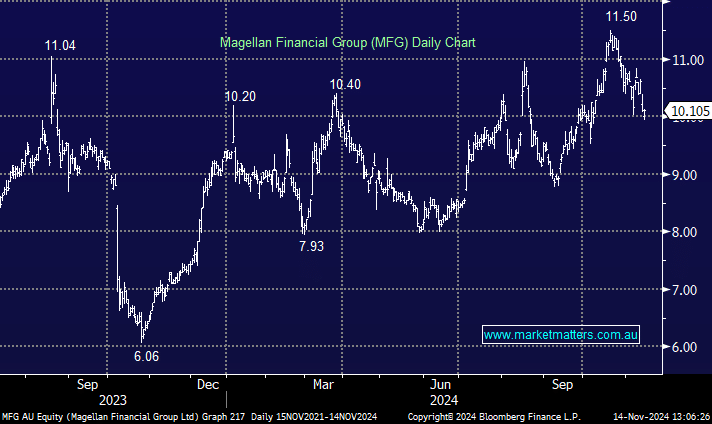

Having held & suffered the decline in MFG, I notice this week the notification of resignation of their CFO. Although obviously not as high profile as Hamish Douglas, should any alarm bells be ringing as to a further retracement of share price or underlying issues? With a strong balance sheet, financial discipline & what appears some good investments in Barrenjoey, Finclear & Vinva should this be potentially be seen as an opportunity to further accumulate & continue to receive the dividend (which moving forward so accrue greater Franking Credits). They have no debt & are still highly profitable. I notice their global fund is still somewhat underperforming their MSCI benchmark; however, is still performing positively & although outflows have stabilized, they are still continuing? What is your perspective on MFG at levels circa $10p/share? Continue the great work! With thanks, Bernie